Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Why Do We Have Less Investment Than China and India?

Why Do We Have Less Investment Than China and India?

INTRODUCTION

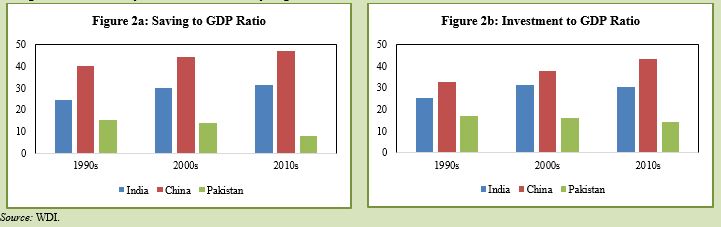

Pakistan has experienced macroeconomic instability since the early seventies. Because of the country’s persistent macroeconomic uncertainty, savings and private investment have been discouraged, resulting in low aggregate investment and volatile output levels. It has one of the lowest investment-to-GDP ratios that is 15 percent, about half of the South Asian average of 30 percent.

Here we will review the evidence from Pakistan to inform policymaking and local research about

(1) The investment trends and patterns in the economy and comparison with its regional counterparts.

(2) The factors which can stimulate the investment.

INVESTMENT TRENDS AND PATTERNS

The investment trends and patterns in the economy provide information to understand the abrupt shifts in economic policies implemented by various governments and their effect on the economy. This overview of the economy highlights the problems due to which investment in Pakistan is still uncertain.

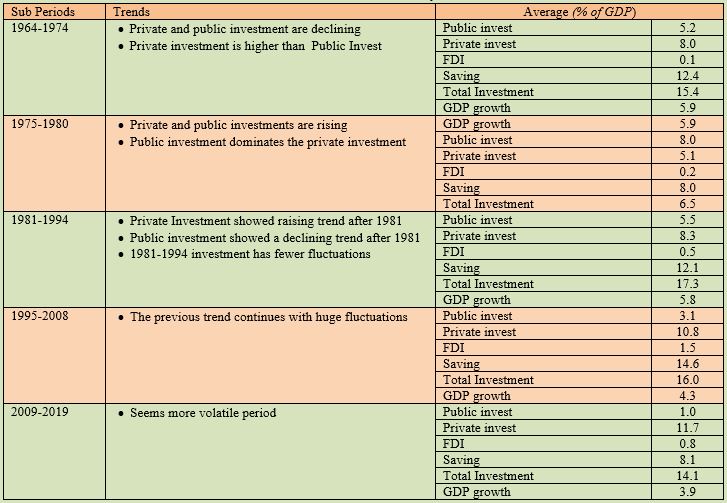

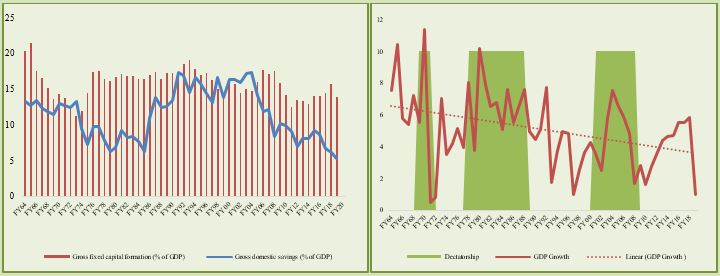

Figure 1, shows the trends and patterns of investment (private, public, and FDI), saving, and gross domestic product. Foreign investment is missing that is around 0.6 percent of GDP, It means that foreign investors are not taking any interest in Pakistan. Pakistan trapped in a low-saving, low-investment trap, which limiting its economic potential and long run growth of Pakistan, which is volatile and declining. Private and public invest follow a mixed trends that why, Figure 1, is further divided into five sub periods contingent upon the trends of private and public investment. So that we know the internal and external factors that cause low investment rate in Pakistan (see Table 1).

Table 1

Private and Public Investments Trends in five Sub Periods

2.1. Internal and External Factors Behind the Private and Public Investment of Pakistan[1]

1964-1974

- During the 1950s and 1960s, the private sector was a major channel of industrial investment in main areas such as banking, insurance, certain basic industries, and trade in major commodities.

- Foreign investment was not allowed in the field of banking, insurance, and commerce (Khan & Kim, 1999).

- The main cause behind the declining trend of public investment was the 1965 Pak-India war and the 1971 Pak-India civil war in East Pakistan.

- Massive non-development expenditure left an insufficient resource for investment and development purposes.

- In the Ayub regime, private investment was encouraged by concentrating on rapid industrialisation with intensive efforts by the government to promote large scale-manufacturing sector through expansionary/easy macroeconomic policies including the facility of tax holidays, tax rebates, and availability of credit.

- The high growth rate during the 1960s was also supported by foreign aid and assistance along with policies adopted by the government.

- The disastrous civil war with India in 1971 and large-scale nationalisation adversely influenced the economic growth due to loss of competitiveness in the industry, fall in private investment and shift the trade structure by externalising Pakistan’s internal trade.

1975-1980

- Private and public investments are rising and Public investment dominates the private investment.

- The prime reason behind this trend is the nationalisation policy of Bhutto’s government.

- Large-scale nationalisation of private industrial units and financial institutions.

- Public investment accounted for two-thirds (2/3) of total investment.

- Private investors discourage due to government nationalisation and the abolition of tax holidays policies.

- In 1977, Zia’s military rule came and nationalisation policy was revised gradually and a mixed economy policy framework was implemented by the government.

- The ‘macroeconomic turmoil’ from 1978-80 caused a fall in total investment in many developing economies including Pakistan.

1981-1994

- Private investment showed raising trend after 1981 and public investment showed a declining trend after 1981.

- The government had announced the industrial policy in 1984.

- The confidence of private investors grew gradually through the denationalisation of many industrial units and shifting policy towards the pre-1970 policies of investment incentives including five-year tax holidays, import duty reduction on raw material, reduction in the interest rate, and denationalisation of agro-based industries.

- Zia’s government adopted several policy measures to attract foreign investment such as exchange rate liberalisation policy, export processing zone (EPZ) to encourage export-oriented industries.

- Foreign investment remained at low levels during the Zia regime.

- This could be attributed to certain factors including strict licensing and price controls policies, underdeveloped and inefficient financial sector, significant public ownership, high tariffs, and non-competitive trade regime, etc.

- Growth trends were not impressive but improved significantly in comparison to the 1970s period.

- After the Zia regime, the new democratic government came into being and faced the problems of the high budget deficit and worsening balance of payments position and resultantly led the government seeking foreign assistance. Government borrowed from International Monetary Fund (IMF) and started the Structural Adjustment Program (SAP) of IMF in the country.

- The establishment of the Pakistan Board of Investment in 1990 helped generate opportunities for FDI within Pakistan and provide investment services to interested foreign investors. These initiatives placed Pakistan on the International Finance Corporation’s list of emerging South Asian stock markets in 1992.

- In 1985 the global economic recession hit the world economy, but it did not significantly impact the Pakistan economy because at that time the economy was not widely opened.

- In 1988 The Gulf crisis originated and many migrants working in the Middle East were sent back home and caused a sharp decline in remittances.

__________________________________

[1] This information is taken from Khan and Khilji,(1997), Ahmad (2007), Ahmad and Qayyum (2008, 2009), Farooq (2008), Abbas (2011), Hina (2013), and Lavingia (2016).

1995-2008

- 1990 decade is important for Pakistan’s economy; as financial sector reforms were started to promote the private sector and encourage foreign investors.

- The condition of government approval for foreign investment was removed both in industrial and non-industrial sectors.

- Tax holidays, reduction/exemption of customs duty, sales tax, and removal of tariffs, easy visa policy, and certain fiscal incentives were granted to local and foreign investors. Privatisation policy was started in the country.

- Because of these measures, private (domestic) and foreign (direct) investments showed progress and a positive trend was witnessed in both, while public investment followed a slowing and downward trend.

- Total investment and growth in Pakistan showed downturn trend in the wave of Asian financial crisis in 1997 quite similar trends observed in many other Asian countries.

- The worsened political situation prevailing in the 1990s and economic sanctions imposed in the wake of nuclear tests in May 1998.

- In 1999 the government was collapsed, and Dictator General Pervez Musharraf took over the charge.

- In September 2001, the incident of World Trade Centre (9/11) occurred and it changed the entire scenario of the world and the region as well.

- During Musharraf’s rule, the exchange rate remained almost stable at Rs. 60 per US dollar. This stability was contributed to high inflows of remittances and foreign capital inflows to Pakistan.

- The majority of investment policies during the 2000s were based on the notion of privatisation and deregulation. The policy aimed to promote investment in sophisticated, high-tech, and export-oriented industries. While almost all economic operation has been thoroughly open to foreign investment in all other sectors, agriculture, services, infrastructure, etc., with all fiscal and other incentives including loan financing from local banks.

- The level of growth experienced during the early years of the 2000s was impressive, it is important to note that the nation’s FDI levels lagged behind the rest of the developing world. In 2007 capital inflows to Pakistan were 4 percent of GDP while average capital inflows to other developing countries were 7.5 percent of GDP this difference stem from an unstable political environment, inadequate infrastructure, and high levels of security risk.

- The global financial crisis of 2008 originated in the US had affected the Pakistan economy like other economies of the world, economic growth declined from 8 percent in 2004 to 2 percent in 2008.

- The global financial crash of 2008 induced further stress on the domestic economy as Pakistani exporters struggled to sell their goods to the nation’s largest export market, the United States. Deteriorating diplomatic relations and failure by the Pakistani government to service the nation’s debt increased uncertainty over future returns, discouraging foreign firms to invest in Pakistan.

2009-2019

- With the new democratic government in 2008 economy moved from rapid rates of growth to a state of crisis. Real GDP growth slowed sharply and foreign exchange reserves plunged.

- The shortage of energy and rising security concerns challenged the nation’s capacity to attract foreign investors.

- The PPP government focused on short-term crisis management. Despite reluctance to rely on the IMF, the government turned to the organisation for assistance in November 2008. By accepting IMF financing, the Pakistani government lost an extensive degree of autonomy in designing economic policy and was required to eliminate subsidies in sectors like Energy. Investment growth continued to contract, curtailing public expenditure.

- The investment to GDP ratio stood at 12.5 percent in 2011 at the lowest level. Pakistan’s decision to participate in the War on Terror, Pakistan has been perceived as a nation with poor national security. These limitations along with poor government efficacy and political instability have resulted in FDI moving away from Pakistan and towards those developing markets that are less risky to foreign investors.

- Osama Bin Laden’s arrest by US Special Forces in 2011 refocused negative attention on Pakistan. Security issues arose as a result of questions about the Pakistani government’s ability and willingness to fight terrorism, contributing to a further withdrawal of FDI.

- Following the national elections of 2013, PML-N elected government prioritised to control the domestic energy crisis and curb terrorism for political stability. However, due to constant power outages, poor basic infrastructure, and weak security conditions, Pakistan has been unable to take full advantage of international economic stability and opportunity.

- In 2014 the Board of Investment introduced several additional incentives for foreign investors including 100 percent tax credit for five years on new industries established by June 30th, 2016, as well as credit for investment in infrastructure updates, extensions, and replacements.

- The development of the China-Pakistan Economic Corridor (CPEC), has allowed foreign investment within Pakistan to increase again, especially in the telecommunication, energy, and transportation sectors. Such a partnership is likely to help boost the economy and promote foreign investment within the country.

- PTI government had come into power following the 2018 general elections, it had introduced a strict financial discipline to curtail excessive government expenditure, introduce market-driven exchange rate, and remove large tax exemptions.

- The PTI government followed a liberal foreign investment regime and introduced measures to promote Ease of Doing Business (EoDB) in the country.

- Increased SBP policy rate declined private sector borrowing significantly and an increase in our overall debt.

- Business confidence is low because the government has been uncertain about economic policies and results in high inflation with falling per capita GDP.

We Learnt from Section 2,

Investment remained at low levels due to:

- Unfavourable investment incentive, underdeveloped and inefficient financial sector, significant public ownership, high tariffs, and non-competitive trade regime.

- The market is overregulated by the government

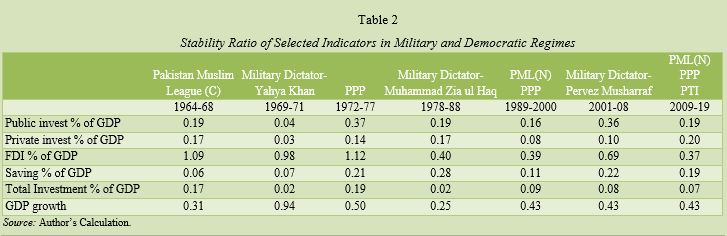

- Government instability and political violence: Pakistan doesn’t have a good system to run state affairs. Each political party has a different mindset and policies for Pakistan. Not a single party wants to discuss the issues of Pakistan and what Pakistan needed rather protect their self-interests. Therefore, it can be seen from Table 2, that total investment in democracy is highly volatile/uncertain.

| Box 2: Stability Ratio The stability ratio (standard deviation as a percentage of mean) is used to measure the volatility. Standard deviation is not the best measure of volatility, especially when comparing the different eras when the mean of the series is also different. The stability ratio encounters both mean and standard deviation and provides information about which subsample has a higher standard deviation relative to the mean. |

Low Saving and Investment Rates in Pakistan

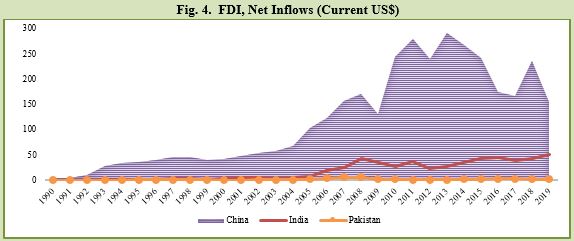

In comparison with Indian and China, Pakistan has the lowest level of domestic investment and saving that is 14 percent and 8 percent in the 2010s. Whereas in India investment rate is at 30.3 percent and the saving rate is at 31.2 percent, China has the highest investment rate of 43 percent and saving rate of 47 percent. It seems that Pakistan has zero or no investment and it is trapped in a low-saving, low-investment cycle that limits its ability to grow.

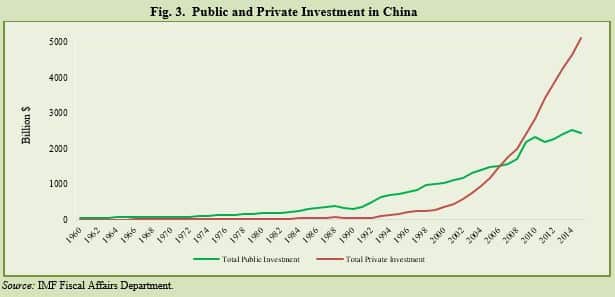

Why China is an Investment Champion

- China’s started its journey as imitators, not as an innovator.

- After the declaration of the ‘Opening-up and Reform’ policy in 1978, China has undergone significant transformations.

- After the 1990s, China adopted new policies that opened up the economy to foreign investment and implemented an unprecedented structure that enabled free enterprise and capitalist ideas to flourish within a socialist framework, resulting in rapid economic and social growth (Ari and Koc, 2020).

- After 1992, private investment per capita in China increased dramatically, eventually surpassing public investment per capita in 2006. From 2006 onward, the Chinese government realised to include innovation as a part of the development strategy.

- China has extraordinary success in attracting FDI over the last 30 years. China’s FDI has grown from almost nothing in 1978 to about USD156 billion in 2019. China’s great success in attracting FDI under a series of policies since 1978, especially the establishment of a dual capital income tax system (from 1992 to 2008), which provides greater tax concessions to foreign-invested enterprises (Zhang, 2011).

- China is mostly reliant on domestic investment rather than foreign direct investment. However, FDI contributes not only to the growth of capital, especially in exports, but also to the transfer of excess capital to international markets. This will aid in the transfer of knowledge in the development of human resources (Hina, 2021).

- From the late 1990s, the Chinese government started to strengthen its innovation system and in 2020, innovation in China has taken dramatically on public and business levels. The struggle of three decades on three main factors has led China as a technological leader.

- The strong role of government.

- Largest domestic market.

- Scientific research.

How India Stand out in Investment?

- Local industries established in the late 1960s therefore, the Indian government implemented a more preventive attitude towards FDI.

- In 1973, the new Foreign Exchange Regulation Act (FERA) came into effect, requiring all foreign companies operating in India to register under Indian corporate law with equity capital of up to 40 percent (Kumar, 2003).

· The increase in investments in the mid-1970s was the result of an increase in investments in machinery/equipment. In the early 1970s, more was invested in infrastructure than in equipment. Among the different types of investments, it is the equipment investments that matter most for economic growth (DeLong and Lawrence, 1991).· The high investment rate is also credited to the financial deepening and expansion of the banking sector in the 1970s and 1980s. Because banks had access to household savings, they could lend to households as well as to businesses.

- In the 1980s, India brought historical changes in its FDI policy. FDI was now considered as a source to earn foreign exchange reserves rather than acting as a supplement to local industries.

· In the 1980s, India made historic changes to its FDI policy. FDI was seen as a means of acquiring foreign exchange reserves rather than as a supplement to local industries.· The low productivity and inefficiency of local industries are considered to be the result of excessive protection provided to Indian industries from the international market. Such protections made local industries inefficient as compared to other developing countries that pursued liberal FDI policies.· Foreign direct investment policy in India was reformed by introducing liberal measures. In 1991, India implemented a new economic policy. Since then, India’s economy has undergone systematic changes from a highly state-controlled government to a more liberal and outwardly, market-friendly system. · A series of measures to improve productivity, quality and reduce production costs were gradually introduced (Choudhury, 2018). The lifting of the ban on foreign industries by FERA was a major reform.

- The services sector was opened up to foreign direct investors, especially in the real estate, telecommunications, and banking sectors. In recent years, a series of policy measures have been announced to liberalise the FDI in the country. Gradually, almost all sectors have been opened up to the influx of foreign investment. As a result, India today has one of the most attractive FDI policies in the South Asian region (Sahoo, 2006).

The informal sector is a big part of the Indian economy. The share of informal employees in the participating labour force is approximately 92 percent. India has taken several steps to address informality, including targeted schemes to promote micro, small, and medium-sized enterprises and legislative measures such as Unorganised Workers Social Security Act, the Contract Labour (Abolition and Regulation) act. And the Workers’ Welfare Board. Microfinance has emerged as a means of lending to the informal sector. Since the mid-1980s, the National Bank for Agriculture and Rural Development (NABARD) has been active in a program linking mainstream banks to “self-help groups” (SHGs). Recently, there has been a significant increase in funding for this program in the thirteen priority states that accounts for 70 percent of Indian’s poor population. In March 2006, 2.2 million SHGs were connected to regular banks and 33 million poor households had to access to microfinance. NABARD also helps other partner organisations such as NGOs and cooperative banks to promote SHG (Choudhury, 2018).

We Learn from China and India

- Innovation in productivity and management has crucial importance.

- The creation of the linkages between academia and firms for the development of required skills is compulsory which China has created in their innovation process.

- The government should start prioritising technology, science, and innovation as the main pillars for medium and long-term growth as China has done.

- Open the services sector like real estate, telecommunications, and banking sectors to foreign direct investors.

- Overprotection results in low productivity and inefficiency of local industries.

- Equipment investment rather than infrastructure investment matters most for economic growth.

REFERENCES

Abbas, A. (2011), Essays on investment behaviour in Pakistan, PhD Thesis, PIDE.

Ahmad, I. (2007). Measuring the effects of public expenditures and macroeconomic uncertainty on private investment: The case of Pakistan, PhD Thesis, PIDE.

Ahmad, I., & Qayyum, A. (2008). Effect of government spending and macroeconomic uncertainty on private investment in services sector: Evidence from Pakistan. European Journal of Economics, Finance and Administrative Sciences, 11, 84–96.

Ahmad, I., & Qayyum, A. (2009). Role of public expenditures and macroeconomic uncertainty in determining private investment in large scale manufacturing sector in Pakistan. International Research Journal of Finance and Economics, 26, 34–40.

Ari I, Koc M. (2020). Economic growth, public and private investment: A comparative study of China and the United States. Sustainability, 12(6), 22–43.

Choudhury, R. N. (2018). Determinant of foreign direct investment in India’s e-commerce sector (ISAS Working Paper No. 291). Singapore: Institute of South Asian Studies, National University of Singapore.

Choudhury, R. N. (2018). FDI in India and Pakistan: Potential sectors for bilateral investment. South Asian Survey, 25(1-2), 129–162.

DeLong, J. Bradford, and Lawrence H. Summers (1991). Equipment investment and economic growth. Quarterly Journal of Economics, 106(2), 445–502.

Farooq, U. (2008). Economic and non-economic determinants of private investment: A case study of Pakistan, MPhil Thesis, PIDE.

Hina, H. (2013). Effects of global financial crisis on exchange rate dynamics using various theoretical models: An econometric investigation, PhD Thesis, PIDE.

Hina, H. (2021). Unpacking investment crisis in Pakistan, Chapter 1, institutions, policy, reform and research: A national narrative-building through webinars at PIDE, PIDE.

IMF FAD Investment and Capital Stock Database 2017: Estimating Public, Private, and PPP Capital Stocks; International Monetary Fund: Washington, DC, USA, 2017.

Khan, A., & Khilji, N. (1997). Foreign direct investment in Pakistan: Policies and trends [with Comments]. The Pakistan Development Review, 36(4), 959–985.

Kumar, N. (2003). Liberalisation, FDI flows and economic development: An Indian experience in the 1990s (RIS-DP No 65/2003). New Delhi: Research and Information System for the Non-aligned and Other Developing Countries.

Lavingia, S. (2016). Attracting foreign direct investment in Pakistan, Undergraduate Thesis, Oberlin College.

Sahoo, P. (2006). Foreign direct investment in South Asia: Policy, trends, impact and determinants (ADB Institute Discussion Paper No 56). Tokyo: Asian Development Bank Institute.

Zhang, N. (2011). Foreign direct investment in China: Determinants and impacts, unpublished thesis, The University of Exeter.