Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

The Unbearable Cost of Living

Things cost too much, or cannot be afforded as these are in two ways to look at the problem. However, nowadays everyone seems to complain about rapid price escalation of goods & commodities and services, whereas economists usually see inflation as a sign of growth which means that more people are spending therefore the demand of the things is rising. However, in a country like Pakistan simple economic rules do not seem to apply in a plain manner as here almost half of the economy and businesses are undocumented. We have seen a significant rise in the prices of basic commodities in last few years as on the other hand income increase has been minimal. Jalil et al., (2022)[1] also maintained that costs of about hundred products have increased significantly since last year.

Therefore, this high rise in goods’ prices raises many questions that need to be addressed as will this inflation stop, what are the main contributors causing the inflation, who controls the inflation and what are some ways to control it.

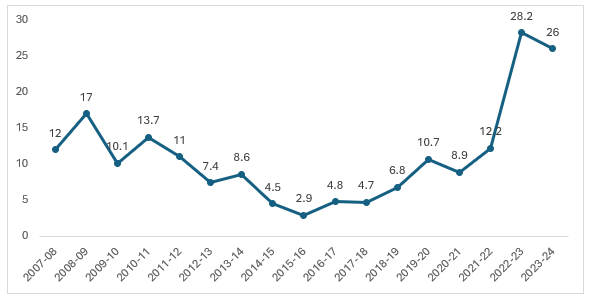

Pakistan has been experiencing a visible surge in inflation since 2020. Historical trends show that Pakistan’s inflation has been consistently high. Although currently, inflation calculated by Consumer Price Index (CPI) has decreased to 26.0% in 2024 from 28.2% in 2023, but urban CPI inflation increased from 25.9% to 26.3% during the last year.

Figure 1: Trend of Consumer Price Index Inflation over the Years

Source: Pakistan Economic Survey 2023-24

The contrasting nature of this impact is rooted in several factors, the most critical of is the gap between aggregate supply and demand in Pakistan. The aggregate demand has been increasing due to the demographic structure and increase of monetary income. In particular, it is the nature and extent of the dependency ratio of a country’s population—the proportion of young age population (below 15 years of age) and old age population (over 64 years of age) to total population which affects inflation outcomes (State Bank report, 2024). Both the young and old cohorts of a population contribute to aggregate demand without providing labour and thus do not contribute to aggregate supply as 31% of young graduates are unemployed whereas share of young population is 60% (Haque and Nayab, 2022)[2].

The other factors causing inflation include exchange rate depreciation, as exchange rate goes up, the imported goods become more expensive. Since the cost of imported goods increases the cost of production that affects domestic pricing and hence raises the inflation. Estimates show that, with 1% exchange depreciation in exchange rate caused the inflation to rise by 14 to 16 basis points. Apart from exchange rate deprecation, other major factors contributing to inflation is surge in petroleum price and increased government’s borrowings. Either these borrowings are from foreign donors or through commercial banks that raises the interest rate and crowds out the private investors or it is taken through the central bank through printing money leading to inflation as “too much money chases the few of goods”. The elasticity of inflation with respect to the government borrowings shows that the inflation may rise 100 bps with a 10 percent increase in the government borrowing (Jalil, 2021)[3]. If this borrowing is used for productive purpose its impact on inflation is small but in case of Pakistan the most of borrowing is done to compensate budget deficit or for repayment of loans.

Now the next question that needs to be addressed is who controls the inflation? Do government’s interventions like price control committees, DC price list etc. help to mitigate the problem. Answer is, yes to some extent. In fact, many economists are of the view that the market should be left to its self-adjustment phenomena and have minimum interference regarding any price controls. According to the economists on State Bank intervention to handle inflation by increasing interest rate to reduce aggregate demand may reduces inflation to some extent, but on other side it ultimately causes to increase in the government debt and private sector’s cost of production. That is why when State Bank controls inflation by increasing interest rate it may reduce the growth rate of country.

Whereas, goal of the country should focus on welfare and prosperity of its people through monetary, fiscal and trade polices meant to promoting economic environment for higher growth rate. Therefore, interest should be used as an instrument only when per capita income of a country reaches a certain level as these policies are only used to speed up sustainable growth, but also boost welfare and prosperity of the common masses. On fiscal side, besides increasing tax-net, the public expenditure should be controlled particularly the non-development expenditure through cutting down all unnecessary perks, privileges and amenities right from naib tehsildars’ level to ministers, prime minister, chief ministers, governors and president. On trade side, besides increasing total volume of exports, value added/qualities of exports should have to be improved and be diversified and dependence on imports should be reduced to a significant level. While a business-friendly environment can contribute to lower inflation by enhancing supply, reducing costs, and fostering competition. Therefore, the government should reduce the over regulation like plethora of unnecessary NOC’s for new startups and provide the enabling environment for businesses as it will not help to fulfil the domestic demands of the economy but will also enhance the export of goods and services.

[1] Jalil, A., Rao, N. H., Hasan, M. U., & Mirza, F. A. (2022). Inflation Analytics (No. 2022: 6). Pakistan Institute of Development Economics.

[2] Haque, N., & Nayab, D. (2022). Opportunity to Excel: Now and Future, PIDE Report.

[3] Jalil, A. (2021). Drivers of Inflation: From Roots to Regressions. PIDE Knowledge Brief No. 38.