Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

The Nuisance of Own Money in Automobile Purchases

The Nuisance of Own Money in Automobile Purchases

Own Money: In A Nutshell

Own Money: A premium charge for immediate ownership of an automobile being sold. The supply side of passenger car manufacturing as we know it, is not functioning at full capacity. Artificial shortage is created – giving rise to the “own money” culture. The demand side has gotten habitual of this. Demand side is guilty of encouraging “own money” culture, but it is not the primary culprit.

INTRODUCTION TO OWN MONEY

The constant gap in demand and supply of vehicles in Pakistan gave birth to a phenomenon unique even today to the Pakistani automobile market known as the ‘own money’ for brand new vehicles. For immediate possession of an automobile that has been purchased, the buyer must pay a premium charge: own money. The question is, what is this own money, and why must one pay this to possess something one has already paid for?

In the early 2000s, when car sales in Pakistan rose sharply, aided by the banks’ introduction of car financing services, the demand and supply gap widened. The number of buyers increased rapidly, while vehicle production capacities did not significantly increase to match this rise in demand, resulting in an increased waiting period for the delivery after booking the vehicle. An opportunity to earn commission was created for those in the middle of the supply chain, i.e., the 3S2 dealerships.

At the time of vehicle shortages and production delays, the car dealers started charging own money for quick delivery of brand- new vehicles. Own money is a premium charged over and above the quoted price of a vehicle for immediate delivery. For instance, the company ABC sets the market price of its vehicle X at PKR 2 million inclusive of all taxes, but the tentative delivery date is six months from the booking date. The buyer is forced to pay a considerable amount and wait for an extended period. This allowed the car dealers to develop the process of own money, where they offer the buyers a way out at the time of booking. As a result, the buyer is given the option to pay an ‘m’ amount of money, over and above the price quoted by the company, and get the car within a week, even the same day in some cases. By paying this own money, the buyer is then relieved of the waiting time for vehicle delivery and obtains ownership of the car immediately.

The question that arises is when the company is taking a much more extended period to produce and deliver vehicles, how can the dealers offer express delivery? Does that mean the companies are directly involved in encouraging the culture of own money on the sale of cars or indirectly seeking the benefits of this culture? This knowledge brief sheds light on the industry’s current structure and highlights the slim margins between production and sales in virtually all sub-sectors of the industry. The own mechanism is discussed, followed by the implications for consumers and a possible way to reign in the nuisance of own money.

FOSTERING THE OWN CULTURE

The automobile industry of Pakistan was set up with the assistance of foreign firms by forming joint venture agreements to facilitating the transfer of technology and know-how for manufacturing automotive vehicles of all types. Income levels in the country have influenced the growth of the industry sectors; the motorcycle and small automobiles have become the workhorses of the low and lower-middle-income groups of the economy, while high powered luxury sedans are the preferred choice for the higher-income bracket in the economy. In the motorcycle industry, the established Original Equipment Manufacturer (OEMs) are facing stiff competition from the new incumbents from China, but recent trends indicate they are managing to hold their own, no doubt capitalising on a brand name, quality, and after-sale service while the Chinese brands are focusing on undercutting the price (Qadir, 2016).

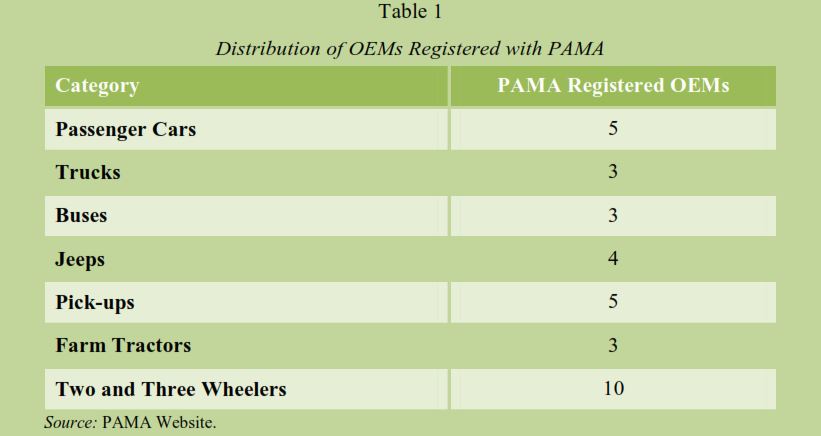

The domestic automobile industry in Pakistan is comprised of several OEM firms that are manufacturing a variety of products in the industry, ranging from two and three-wheelers to passenger cars, commercial vehicles, and even buses, trucks, and tractors. The distribution of these manufacturers is skewed in favour of two and three-wheelers (motorcycles and autorickshaws), and there is a high degree of concentration in the remaining segments of the industry.

______________________________________

1This analysis has been motivated by discussions with Dr. Nadeem Ul Haque, Vice Chancellor, PIDE. We are also grateful to Mr. Nabeel Anwar for gathering data and invaluable contribution in understanding the culture of own money.

The author is grateful to Dr Nadeem Ul Haque, Vice Chancellor, PIDE for ideas/ comments on the earlier draft of this brief.

23S dealerships are car dealers associated with a certain automobile manufacturer providing Sales, Service and Spare Parts Management services to the costumers. They act as the middleman or as bridge between the car manufacturers and buyers for sales and after-sale services.

The own money culture is not hidden from anyone, and while the regulators (i.e., Auto Industry Development Committee on the supply side, and Competition Commission of Pakistan on the demand or market side) and companies might not be actively involved in this, but they have not taken any steps to curb the practice. Instead, their inactions have ended up aiding the own culture.

The own money culture is not hidden from anyone, and while the regulators (i.e., Auto Industry Development Committee on the supply side, and Competition Commission of Pakistan on the demand or market side) and companies might not be actively involved in this, but they have not taken any steps to curb the practice. Instead, their inactions have ended up aiding the own culture.

When a company opens bookings for a new vehicle, the 3S dealers themselves book several vehicles. Not only does this create artificial demand at the time of booking, but it also creates hypes about the vehicle in the market. As a result, more people are pushed to book their vehicle as soon as possible due to rising bookings. This creates a fear among potential buyers that waiting a while before booking could result in a much longer waiting period; thus better to book immediately. This overbooking causes severe issues for the companies who are unable to meet the demand, leaving the field open for 3S dealers to exploit buyers. As a result, when the vehicles booked by the 3S dealers are delivered to them, they start offering the car to buyers with an immediate delivery under the condition they pay some premium over and above the car’s actual price. This premium, as mentioned above, is known as the own money.3

| Time Cost of Money and Pakistan’s Own Culture We work under the assumption that the buyer has two options: A: To pay a large sum of money to book their vehicle and wait for a long period of time for the car delivery. For the time that the car has been booked but not yet delivered, the money can be referred to as a dead investment as there is no return or utility being gained by the consumer. B: To pay a premium, referred in local automobile market as own money, and get the vehicle immediately. Analysing the opportunity costs attached to the above situations, many buyers tend to prefer option B, as for them the social cost of waiting a long period of time for the vehicle delivery with dead capital paid to the company is greater than the total cost of getting the vehicle immediately by paying a premium or own money. Summing, the deep rootedness of own culture in Pakistan’s automobile sector can be explained through basic economics concepts. Artificial shortage is created by intentional overbookings and under manufacturing, thus nurturing supply-demand distortions and then through 3S dealerships primarily, and elsewhere as well, customers are made to choose between options A and B as described above based on their individual opportunity and time costs of money. |

_________________________________

3This discussion is based on information collected from interviews with various stakeholders in the industry, including those from several dealerships.

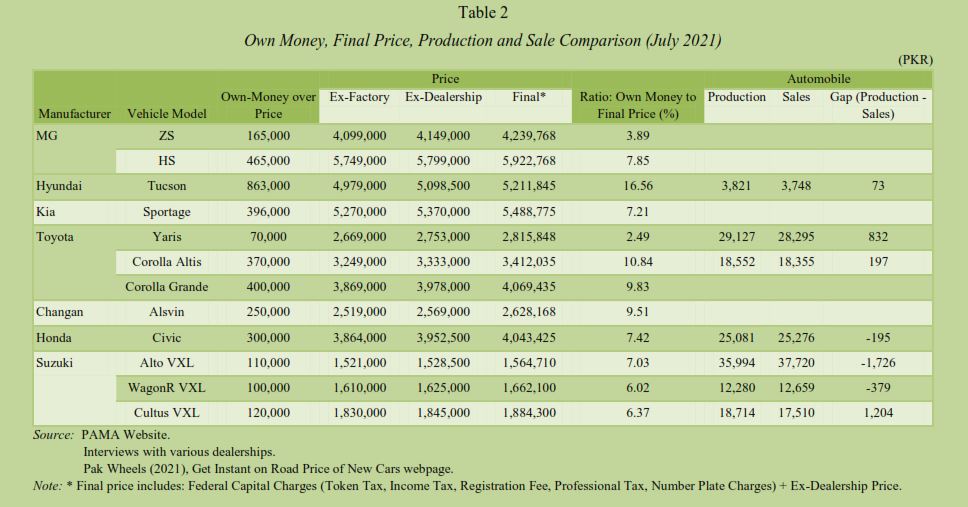

While regulators and companies are rightly criticised for harbouring the own money culture in Pakistan, and the 3S dealers held the most responsible for being at helm of the affairs in this, a lot of responsibility lies upon the buyers as w ell who are willing to pay the premium amount thus giving the dealers the message that not only they willing to pay extra for an immediate delivery. In economic theory, this can be described as the “Time Cost of Money.” Situational Analysis of this is explained in the Table 2.

The own money culture has become so common and successful in Pakistan’s automobile market that only the 3S dealerships are not profiteering from this mechanism. Instead, many private dealers have developed their entire business model on the own money concept. These private dealers now do not deal in secondhand cars but rather deal in brand new vehicles only (a snapshot of own money, the final price of the vehicle, and supply-side trends are given in Table 2 to highlight these distortions). They book new cars from multiple companies and then sell them to consumers who are willing to pay extra for buying the car immediately instead of waiting for months. These dealers’ edge over 3S dealerships is that 3S dealers can deal in only one company’s vehicles whereas the private dealers have no such restriction.

The own money culture has become so common and successful in Pakistan’s automobile market that only the 3S dealerships are not profiteering from this mechanism. Instead, many private dealers have developed their entire business model on the own money concept. These private dealers now do not deal in secondhand cars but rather deal in brand new vehicles only (a snapshot of own money, the final price of the vehicle, and supply-side trends are given in Table 2 to highlight these distortions). They book new cars from multiple companies and then sell them to consumers who are willing to pay extra for buying the car immediately instead of waiting for months. These dealers’ edge over 3S dealerships is that 3S dealers can deal in only one company’s vehicles whereas the private dealers have no such restriction.

As own money at any given time is impacted by the market forces of demand and supply, there is a fluctuation in the ownmoney demanded on every car. So, if the demand and supply gap for a certain vehicle is lower, with a minimal waiting period, then the own money demanded will either be relatively low or none. On the other hand, as the demand-supply gap widens and the waiting period increases, the own-money rate also increases. Consequently, the private dealers, due to diversification, can cater to such risks. In contrast, for the 3S dealers, the risk levels are higher as they might not be able to earn the profits as they planned by twisting the consumer’s hands if the automobile company is adequately managing its supply.

A look at own money, prices, and automobile production and sales data reveal key insights into the working of the automobile market. For one, the ratio of own money to final price of the automobile does not vary according to price, but the perceived popularity in the market. MG is offering luxury vehicles aimed at the upper segmen t of the market, so the own money being charged is higher. Similarly, Toyota Yaris is an entry-level Sedan, so it commands lower own money as compared to the company’s Corolla variants. The Altis and Grande models are highly popular due to their brand recognition and relatively more rugged build, with the model being the go-to option for many rent-a-car services. Hyundai Tucson commands the highest ratio of own money to price, at 16.56.

CONCLUSION

Pakistan appears to have a unique automotive industry, with variety at the higher end of the spectrum in terms of different models being offered, and many variants being offered by a dominant player at the lower end of the spectrum. The culture of charging own money has been credited to production shortfalls that result in demand exceeding supply. On the flip side, consumers are willing to pay whatever premium they are charged to take ownership of a product they have paid for in advance. In the US, dealers charge premiums for their services, but consumers are free to shop around and choose the premium they are willing to pay. The manufacturer identifies a minimum price to the dealers there, below which they cannot sell. The premium above that is negotiable between the dealer and consumer so allowing them to reach a mutually beneficial price and not letting one twist the arm of the other party.

Moreover, given that the production of automobiles in Pakistan is being done on-demand, rather than mass manufacturing, just in time or even lean production, the justification for charging own money does not make sense. This feature of the Pakistan automotive industry bears further analysis, but the current culture of own money in the industry results from the actions of all stakeholders involved. The regulators must fulfil their duty to protect the rights of consumers by crippling the unregulated power at the hands of auto manufacturers. Instead, regulations must focus on creating a market structure facilitating all market players and not tilting to one side only.

REFERENCES

JICA (2011). Project for automobile industry development policy in the Islamic Republic of Pakistan: Main report. Engineering Development Board, Islamabad.

Pakistan Association of Automotive Parts & Accessories Manufacturers (2019). PAAPAM Home, Retrieved from https://www.paapam.com

Pakistan Automotive Manufacturers Association (2010). Pakistan Automobile Manufacturers Association Home. Retrieved from https://pama.org.pk/home

Pak Wheels (2021). Get instant on road price of new cars. Retrieved from https://www.pakwheels.com/new-cars/on-road-price Qadir, U. (2016). Pakistan’s automotive industry: A case of stalled development. PIDE, Islamabad. (PIDE Working Paper Series No. 137).