Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival, PIDE Book Launch Webinar

PIDE Book Launch Webinar

“The Great Demographic Reversal”

Ageing Societies, waning inequality, and an inflation revival

Professor Charles Goodhart presented the main theses of the book followed by a discussion on key points by Manoj Pradhan.

In the advanced economies at any rate the effect of demography and some reversal globalization is going to lead to increased inflation. The main reason is that demographic development in recent decades has been remarkably favorable for the capitalist world and advanced economies.

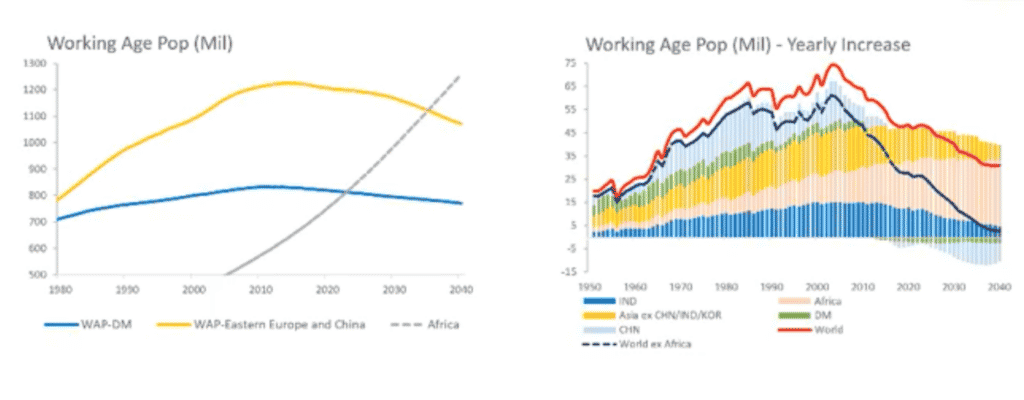

The working-age population falling globally-Africa is the key exception and India to a lesser extent

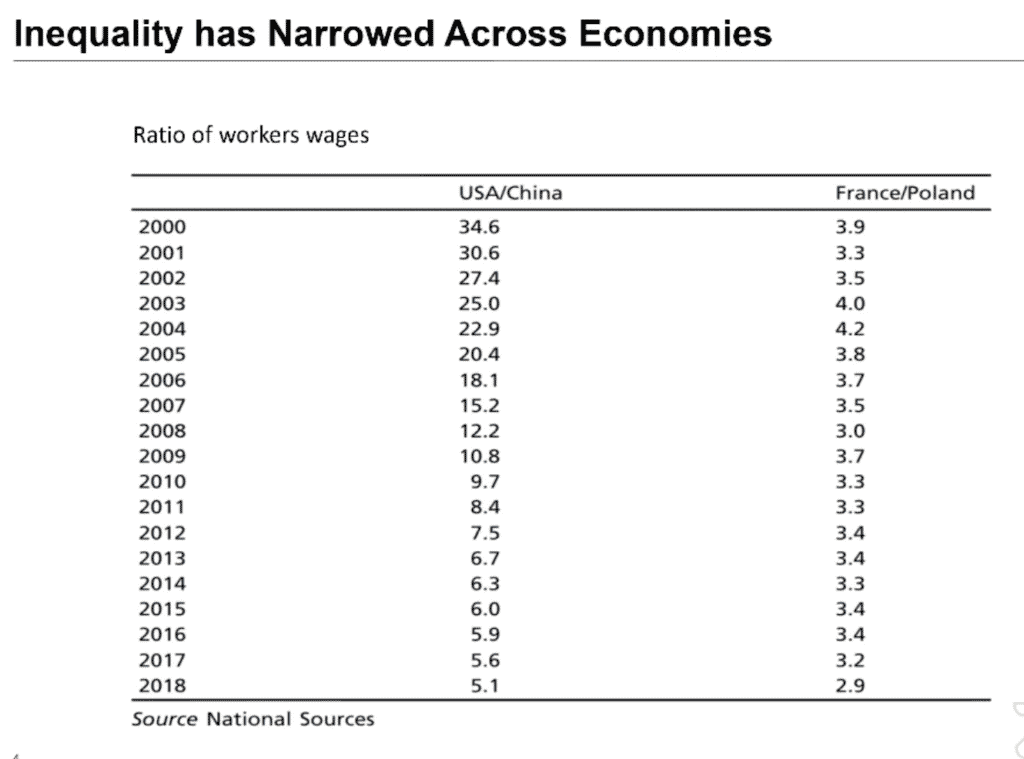

The graph on the left-hand side shows the working-age population with the blue line showing an increase in the working-age population in the advanced economies. This increase in working labor during these last forty years (1980-2020) is attributed to a considerable increase participation rate of women of the working-age population. The yellow line shows the working-age population of China and Eastern Europe that has outnumbered the working age in the advanced economies. This influx of labor has shifted production from higher-wage economies to lower-wage economies in eastern Asia. The graph on the right-hand side shows the increase in working-age till 2010 and since then it has been reversed and the working-age in China and continental Europe (Germany, Spain) has gone down. The ability of the production from high wage economies in the west to low wage economies in the east led to a sharp improvement in world equality. World inequality had been increasing ever since the beginning of the eighteenth century with major development in North America and Europe while the rest of the economies rely on subsistence agriculture. Due to the shift of production from the west to the east, there has been an improvement in equality which can be seen in the following table depicting an extraordinary shift in labor wage ratio between China and the USA from approximately thirty-five to five. This seven-fold growth in less than twenty years is due to China’s enormous growth.

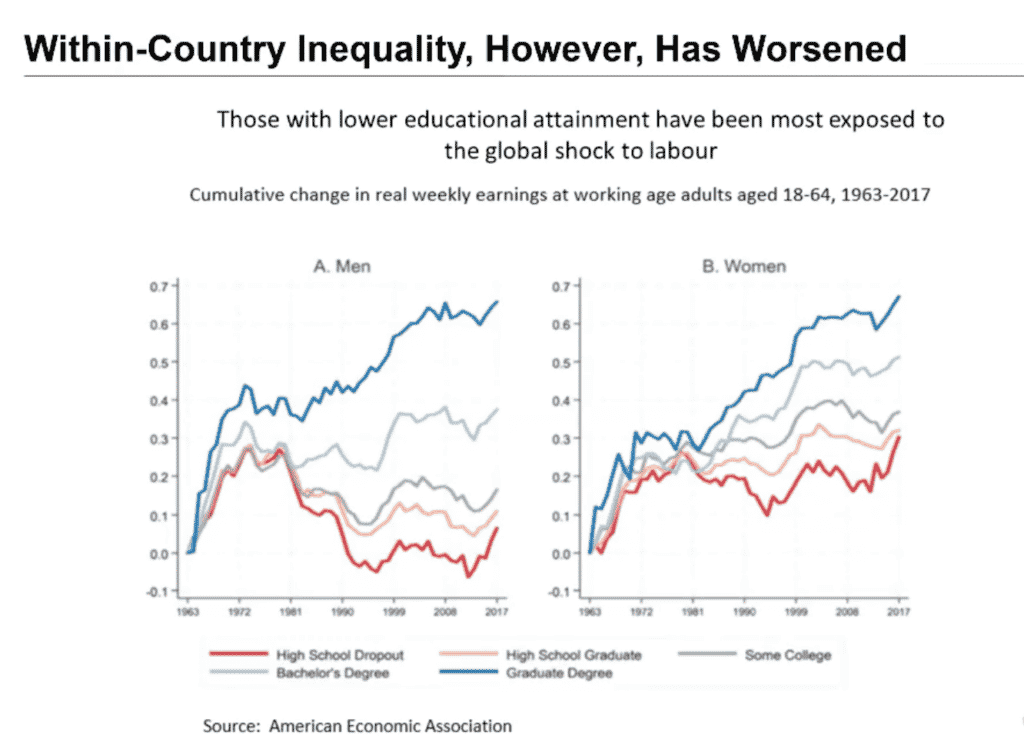

However, these figures imply huge availability of labor and enormous positive labor supply shocks previously recorded. These positive supply shocks and shifting production from high wage to low wage economies led to a sharp increase in inequality sharply in high wage countries particularly in the USA shown in the graph given below indicating a wide earning gap between least and most educated/skilled individuals in both men and women. There is no real increase in wages of least skilled workers since the 1970s while it has drastically increased for higher-level human capital such as managerial and skilled level labor force.

There has been a demographic shift in the advanced economies with a decline in the young population due to low fertility and an increase in the old population due to increased life expectancy. Moreover, consumption has gone up among the old population largely due to increases in consumption of medicines, Medicare, medical assistance, pensions provided by companies and the state. These old-age health support programs are expensive and add up to the public debt and public sector expenditures. The major concern is not about health care being expensive in developed economies, rather it is the continuation of health support with an increasingly aging population in the developed and emerging economies. There is a need to think about the possible ways to deal with debt and public sector expenditure that are increasing with an aging population.

Is Inflation an endgame to deal with debt?

Following are the possible ways to deal with increasing debt in the developed economies with an aging population.

- One of the methods to deal with debt is through growth, as growth increases, the share of debt shrinks over time. However, the challenge is due to the slowing down of the working-age population which is likely to slow down growth because growth is a function of the growth of those who are working and productivity. If the number of workers is going down, then growth can only increase as a result of productivity miracles.

- Productivity per head is expected to rise because, with the decline in globalization, the tendency of companies and investments are expected to return to their home countries. Since the number of workers is declining, therefore, one possible way is through investing more thereby reducing cost per unit of production which will increase productivity which is recently happening in Japan.

- Growth is not being able to deal with the fiscal cost of an aging population; therefore, it can be reduced by increasing the pension age, lowering medical and care benefits to the old by the state, and increase in taxation such as carbon tax and land tax. But this kind of increase in taxes is politically not popular. France experimented with such a kind of tax but was unable to sustain it.

- Higher inflation can be deal with with higher interest rates, but it can have severe consequences on fiscal conditions such as debt accumulation unless fiscal stakes have been taken correctly. Higher interest rates introduce a larger debt burden because the running cost of debt increases sharply. Given that most of the countries are stuck with large corporate debts, it may lead to bankruptcy and financial asset pricing and housing prices may increase fast. With nominal interest, declining might lead to financial collapse. Monetary policy by increasing interest rates is unlikely to deal with the problem.

- Given the political constraints of tightening the benefits of old and raising taxes or raising interest, one way of dealing with the debt burden, although attractive and disliked by old, is inflation. The government may resist considering inflation as a necessary tool but given the current environmental situations around the globe, the government expenditure on infrastructure related to the environment is going to increase, thus leading to higher costs of fuel and that too will have an inflationary effect in the future.

Manoj Pradhan discussed the following three points during his discussion.

- Phillips curve

- The neutral rate of interest and its implication on monetary policy

- The counterargument of the thesis of this book is that with the aging population, why Japan doesn’t have an inflationary effect as we expected to happen.

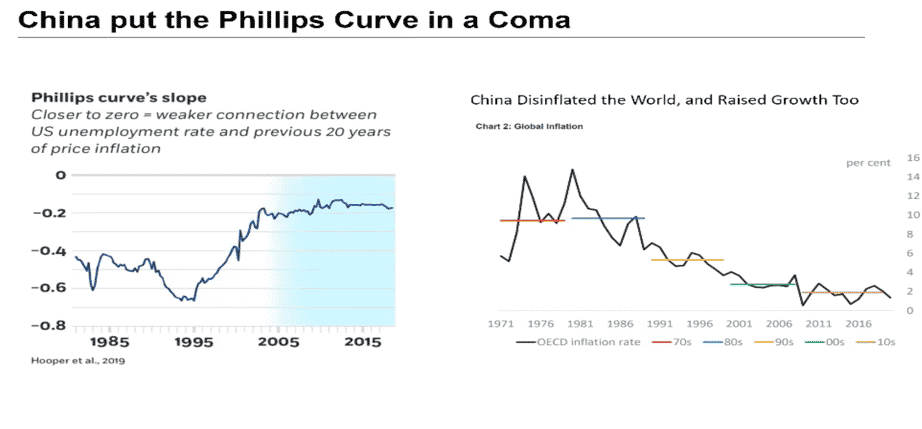

Most people have argued that the Phillip curve is dead or not showing up for a longer period and the Federal Reserve around the developed economies has flattened it. This book argues that it is China that has put the Phillips curve (relationship between the output gap and inflation) in a coma (can be seen in the figure below).

The left-hand side panel of the graph shows that the coefficient of regression of unemployment on inflation is becoming less and less negative implying a tighter labor market is producing less and less inflation until 2000, and eventually this effect is becoming nonexistent thereafter. This shows that Federal Reserve downgraded the Philips curve.

The chart on the right-hand side shows that much of the disinflation globally (shown by colored average lines) is attributed to China. The tightening of the labor market and falling of inflation in the United States are not being driven by developments that happened solely in the US. In other words, the flattening of the Philips curved is misconstrued as a US phenomenon guided by Fed rather than a global phenomenon driven in no small part by China. This implies that the real Phillips curve is in a coma and it is put in a coma by China and if China is no more causing global disinflation then, it is expected that the Philip curve may resurface again.

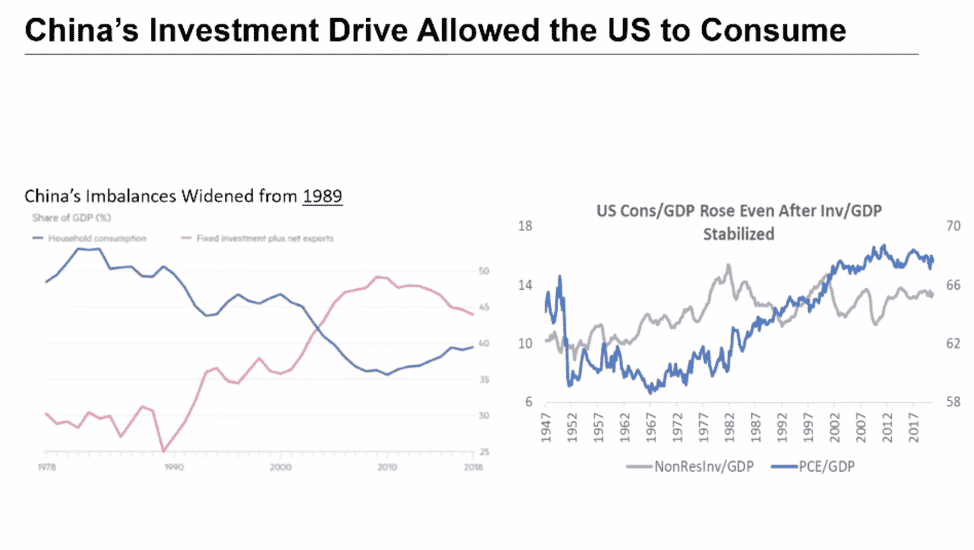

Looking from another perspective, it is evident that China’s investment to GDP ratio widened in the 1980s till 2012 when major policy changes happened. Over the same period, the US consumption to GDP ratio rose steadily which meant that China’s move towards investment induced advanced economies not to invest aggressively and increase consumption. It is important to understand that consumption being less volatile than investment, a larger share of economic activities went to housing which is the period of greater moderation with more employment and less volatility.

The bottom line is the greater volatility in GDP growth and higher inflation should not be discounted by looking at the Phillips curve the way it has been looked at in the past.

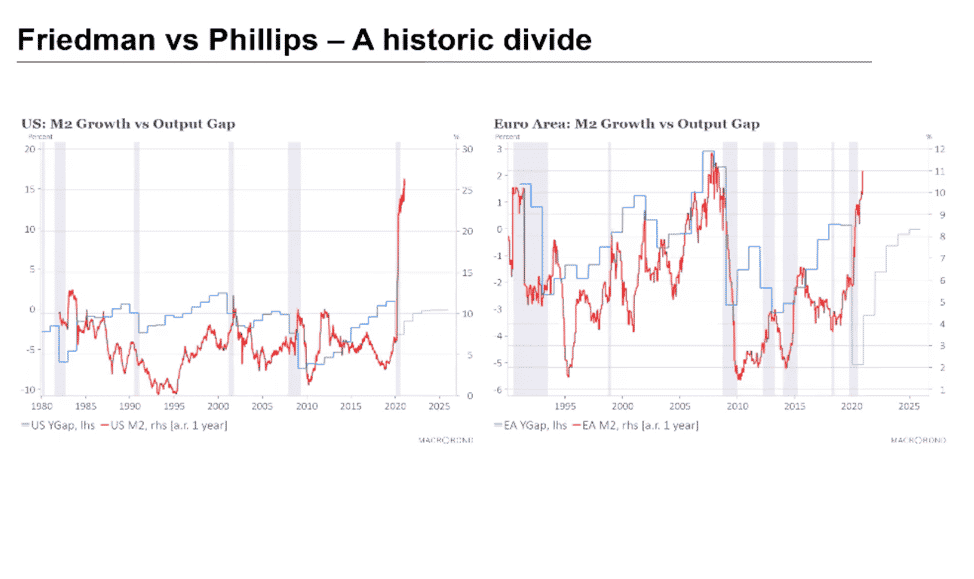

The divide between the two key methods of forecasting inflation has been completed in different directions in the last year. The monetary growth in advanced economies moved up to levels that were not witnessed in the last thirty or forty years.

Looking at the graph on the left-hand side, we can see that monetary growth (M2) of the US has gone to 15% and the output gap is negative, and this is quite a dramatic difference between these two forecasting methods. The reason behind this phenomenon is the low velocity of money in the economy due to lower household expenditure on most of the economic activities during COVID. As a result, savings in advanced economies have gone up. Over time, this phenomenon will change, and the cyclical behavior of inflation and money will result in the resurgence of the Phillips curve.

Interest in the short run vs Long run

One of the arguments made is that demography should lead to falling interest rate “r*” as growth slows down, the interest rate also goes down. This happens due to three reasons. Firstly, when there is a recession, interest tends to move in the same direction either due to a negative output gap or due to a saving-investment gap. During the recession, the investment collapsed down due to low savings and lowers the demand for money. Secondly, the well-known model of “r*” that is Labauch William equations forces the equilibrium r*and output to follow the same trend, but this did not happen in history. Hamilton shows that in the long term there is no relationship between output and interest rate.

What is argued in the book is, over a long time, as households and economies age, they tend to dissave. As the world gets older, the investment will not fall by as much because the elderly do not tend to move home. Secondly, productivity will also tend to go up as the number of workers will fall. Therefore, one of the controversial arguments in the book is that as the world gets older savings will fall but the investment will remain higher pushing the interest rate up for which the world is not prepared.

Why is Japan an exception?

In Japan, the real interest rate is falling with weak growth because their labor force has shrunk at a rate of 1% annually. The productivity is highest among advanced economies at 2% with weak inflation. Japan accumulated debt as most of the advanced economies did. They accumulated debt, but the debt service ratio did not budge because interest rates kept falling in these economies. The key reason why Japan is singled out is that Japan realized that China is a new change in the global economy, therefore, they invested heavily abroad. Most of Japan’s technology and design remained in Japan but investment, employment, profits were generated from outside the world. It found an escape valve in demography that most of us misunderstood.

Conclusion

- Inflation is coming although it is politically disliked, it is unavoidable.

- The yield curve will steepen which was flattened for the last few months. This is a temporary phenomenon.

- Asset returns will be increasingly harder to extract, and emerging economies will benefit from them.

- There will be lower inequality within the countries increasing productivity but with low growth.

Central bank independence will come under increasing threat as their relationship with the government will become increasingly difficult.