Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Special Economic Zones and The State of Pakistan’s Economy

Special Economic Zones and The State of Pakistan’s Economy

Neelum Nigar, Institute of Strategic Studies, Islamabad & Unbreen Qayyum, Pakistan Institute of Development Economics, Islamabad.

INTRODUCTION

Pakistan has initiated various economic reforms aimed at enhancing growth of the economy under China-Pakistan Economic Corridor (CPEC). One of the major components under this collaboration is industrial cooperation under which Special Economic Zones (SEZs) have been planned along the CPEC routes across the country. Over the years, SEZs have been successfully implemented by many countries around the world which include Republic of Korea, Taiwan, China, Vietnam, Bangladesh, Mauritius, the Dominican Republic and El Salvador. These SEZs have paved their way towards industrialisation, economic development and growth. SEZs have also brought Foreign Direct Investment (FDI) to the host country resulting in foreign exchange earnings, enhancing exports and government revenues for the country. Moreover, SEZs have also helped in technology transfers, adoption of modern management practices along with skills up-gradation in most of the emerging economies. While in many countries SEZs have succeeded in transforming their economies, however, it costs the governments in terms of fiscal incentives which are provided to attract investors at the zones. Thus, success does not come without a cost. Also, it is important to draw on the experiences of Pakistan’s neighbouring countries with SEZs and discuss best practices for Pakistan.

REVIEW OF PREVIOUS STUDIES

Global experience suggests that SEZs are an important source of economic diversification, transfer of knowledge and technology, skill development, employment opportunities and promotion of industrial activities in the country (Ali and Faisal, 2016). Numerous studies have shown mix result of SEZs across different countries. In their studies Chen (1993) and Jayanthakumaran (2003) have observed that SEZs are strategic tools which have helped in generating exports and employment yet, many others are susceptive of SEZs being the first-best solutions to ensure competitiveness in an economy, as they argue that the success of such venture is restricted to specific conditions over a limited time frame (Tang 2015). However, a number of other studies still emphasis on the important role of these zones which they play in the economic growth and adjustment processes in many developing countries. According to these studies, SEZs have played a significant role in facilitating industrial development and upgrading processes in the East Asia’s “Tiger Economies.” This model was later adopted by China whosesuccess was unprecedented in history as far as SEZs are concerned. Through this model, China was able to attract huge FDI in the country, which helped in the development of China’s export-oriented manufacturing sector and served as a catalyst for sweeping economic reforms that later were extended throughout the country.

In Pakistan, few studies have been carried out to analyse the potential benefits of SEZs in the context of CPEC. The study by Khan and Anwar (2016) has carried out comparative analysis of Pakistan and China in terms of SEZs. They identify political rent seeking, information and incentives problems as the reasons for the failure of SEZs. Similarly, Hussain and Mehmood (2018) assess the opportunities and challenges that Pakistan faces for effective implementation of SEZs. Zia, et al. (2018) show that the successful experience of African countries with SEZs can be replicated in the developing countries like Pakistan to improve the socio-economic benefits of it for the country.

Similarly, Naeem, et al. (2020), while studying the factors for successful implementation of SEZs conclude that in order to succeed with the planned SEZs under CPEC, it is important to remove political influence and the government must ensure the development of each zone according to its locational advantage. While the above studies have discussed the potentials and challenges of SEZs for Pakistan, they missed to link it with the overall economic state of the country before recommending it as a successful growth model. Moreover, few others which have studied the global experiences have done so in a more general way.

STATE OF PAKISTAN’S ECONOMY

Pakistan is a developing country which ranks at 115 out of 137 countries in the global competitive index 2019. While its ranking is still below that of its neighbouring countries, however, it has improved considerably in its global ranking. At present, the size of the economy (GDP, PPP-adjusted) is US$284 billion with a population of 221 million people (Naeem, et al. 2020). Since beginning, its economy has experienced a weak growth path due to inconsistent economic policies along with weak governance structure which has led to low productivity and weak export base over the years. Agriculture sector’s contribution has reduced to half currently standing at 22 percent, while the industrial sector, which comprises of textile, pharmaceuticals, automobiles, minerals, iron and steel, fertiliser and other electronics, accounts for just 17 percent of its GDP.

3.1. Ease of Doing Business

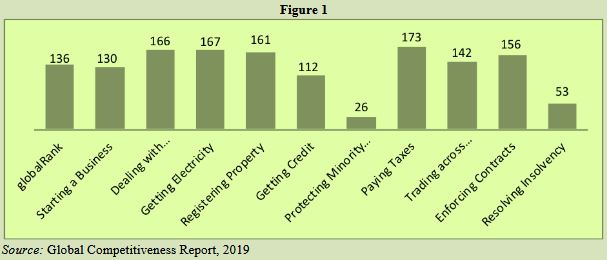

Low growth in the industrial sector is linked to various factors. One of the factors which has stagnated the overall performance of this sector is the poor business climate with weak institutional mechanism in Pakistan. While it is important to note that with concerted efforts, an improvement is found in the overall business regulation in the country; Pakistan ranks at 108 in the global ease of ‘Doing Business’ rankings in 2019. However, on World Bank’s Logistic Performance Index, Pakistan still performs abysmally low. According to World Economic Bank’s 2019 report, Pakistan scored 2.42 out of 5 in the World Bank’s assessment of country’s logistics, showing weak custom clearance process and low quality of logistic services both within and outside the country. These constraints have resulted into low exports to GDP ratio in Pakistan: at 8.2 percent of GDP. It is significantly lower than the average 19.2 percent in the region.

3.2. Productivity

While examining the productivity level in the economy, it is observed that Pakistan’s productivity level is very low and its ranking on the Global Competitiveness Index (GCI) fell from 83 in 2007 to 110 in 2019. Primarily, the principal source of Pakistan’s lack of competitiveness comes from low productivity. The factors which lead to low performance in productivity growth include weak infrastructure including worsening power shortages and extremely low investment in fixed and human capital resources. Moreover, Pakistan ranks among the world’s lowest investors with an investment rate of barely 15 percent of GDP.

3.3. International Trade

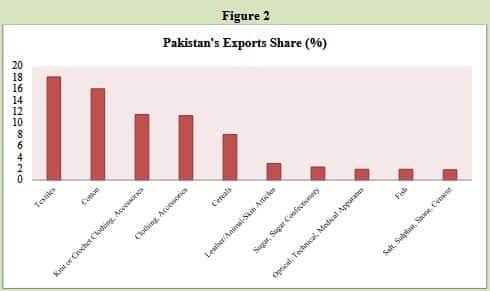

Historically, Pakistan has remained an import intensive country with weak exportable surplus especially in value added variety. The official statistics show that annual global exports from Pakistan are only about US$20 billion which is much lower than its actual potential. The basket of Pakistan’s exports is highly concentrated within a small set of products (Qayyum and Nigar, 2020; Qayyum and Mahmood, 2013). Figure 2 represent the share of each product to Pakistan’s global shipment in 2019. It is significant to note that Pakistan’s export earning is highly dependent on few products only, with ten largest export products contributing 75.6 percent to the total export earnings. In the region, Bangladesh and Myanmar are comparable to Pakistan, with their exports more concentrated in the top ten products, except that the export basket of Bangladesh comprises mainly of manufactured goods, particularly textile products. However in Pakistan, majority of the export earnings is derived from semi-finished goods. In contrast, the richer countries like China and India have far less concentrated export basket.

The statistics reveal several features of Pakistan’s exports presence in global market. Its exports show a high degree of concentration in a narrow set of products, mainly comprising of primary and intermediate goods. The trend, over the time, reveals less dynamism in its export base. While these factors are common in most of the developing countries, in Pakistan, it is more pronounced with a narrow base of valued goods in its exports basket. Based on David Ricardo’s Comparative Advantage Theory, Pakistan has a comparative advantage in textile industry: contributing 60 percent to total exports. However, with low production base, high cost of doing business along with tough competition from regional competitors like Vietnam, Bangladesh, India and China, Pakistan has failed to earn much from this industry. It is, thus, important to devise right policies to enhance the capacity of Pakistan’s manufacturing sector by removing the existing barriers which are being faced by the economic sector of the country.

3.4. Foreign Direct Investment

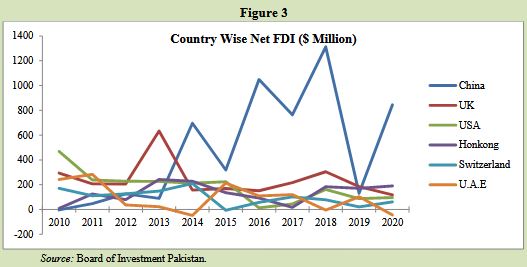

Considering FDI an important component of GDP, World Bank’s statistics has been used to report the FDI inflows for Pakistan along with the comparator countries from year 2010 to 2020. For Pakistan, FDI flows show an upward trend, averaged at US$1908 million per year, or about 0.76 percent of its GDP. However, it is still far below than its neighbouring countries: India with 1.6 percent of its GDP, China 1.5 percent; Bangladesh with 0.9 percent and Myanmar with 3.8 percent. The statistics show that China is the main source of FDI into Pakistan which has risen because of higher investments coming under CPEC.

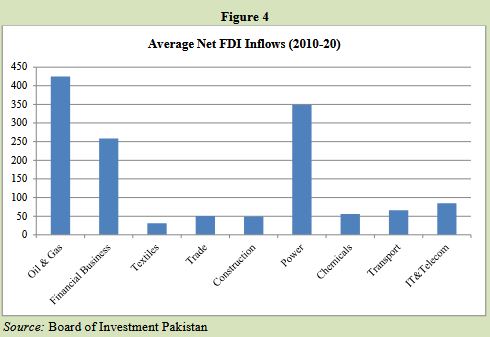

The sectoral decomposition of FDI’s inflows shows that Pakistan has attracted foreign investment in few industries like oil and gas, constructions, and in the financial sector. According to the official statistics, investment in its gas sector has increased to 15 percent of FDI while financial business and textile account for 9 and 10 per cent of FDI, respectively.

The trends in flow of FDI can also be evaluated by looking into the foreign companies’ decision in out-sourcing their production base to other countries. This provides growth opportunity to the host country through integration into the supply chains of these firms. For example: A US-based footwear company, Nike offshores most of its footwear production to the world market. Initially, Nike was more reliant on the Chinese producers but, with rising wages in China, it has shifted its production centres to the developing countries like Vietnam, Bangladesh and Cambodia. It is pertinent to note that Nike’s annual report shows that 40 percent of the company’s global footwear production is currently produced in Vietnam. This case study suggests that Pakistan could also attract large multinational firms like Nike if it brings reforms in the industrial sector while addressing the constraints which have hampered the growth of Pakistan’s manufacturing sector. This will help in getting integrated to the global supply chains, by supplying low-cost, labour-intensive manufacturing especially in garment, footwear and food product sectors while competing with the other South Asian countries for its fair share of FDI in the given sectors.

3.5. The Way Forward

To summarise, Pakistan must enhance the productivity levels of its industrial firms while formulating and implementing an effective industrial policy. It is important to reduce the trade cost and other barriers to trade, this includes, lowering tariffs, reducing quotas along with providing the right business environment to attract investments from foreign firms in the country. This could be done by tools like SEZs which comprehensively reduces all trade cost for operating firms in particular geographical areas in the country.

SPECIAL ECONOMIC ZONES IN PAKISTAN

4.1. Industrial Clusters

Pakistan has been focusing on developing SEZs to facilitate industrialisation in the country. Initially, the focus was directed towards cluster-based industrial development in which the clusters like industrial estates were formed (Kemal, 2006). In 1973, small industrial units were established around various locations in Pakistan but, unfortunately, the pace of industrialisation was lost due to poor management, weak infrastructure development and inability to provide attractive incentives to private entrepreneurs (Hameed, et al. 2015). Similarly, the industrial clusters were formed to encourage the social and economic development of related community. The few successful industrial clusters include: Sialkot Surgical Goods Cluster, Gujarat Ceramic/pottery Industrial Cluster, Faisalabad Readymade Garments Manufacturing Cluster, KPK Marble Cluster, Tannery/Leather Industrial Cluster and Gujranwala Cluster.

4.2. Initialisation of Special Economic Zones

Khairpur Special Economic Zone (KSEZ) was the first designated SEZ which was developed by the Government of Sindh in Tando Nazar Ali. It was designated as a hub of agro-processing and other related industries spreading over 140 acres. Unfortunately, this SEZ is still non-functional as electricity and gas approvals are pending partly because the Sindh Building Control Authority has not yet approved rezoning agricultural land to industrial land. Without such approvals, the responsible bodies are unable to lay the transmission lines within required legalities, thus, stagnating development of this zone.

4.3. Special Economic Zone Act

Considering the prospective opportunities under CPEC, Pakistan’s Board of Investment (BOI) proposed amendments to the Special Economic Zone Act, 2012 which was later promulgated as Special Economic (amendment) Ordinance 2015. The board has given fiscal benefits to the prospective investors and developers at the zones. This includes one-time exemption from custom duties and taxes for all capital goods imported into Pakistan for the development, operations and maintenance of a SEZ and exemption from all taxes on income for a period of ten years. At present, for early execution of SEZs, the government has chosen four SEZs for immediate ground-breaking, these include Allama Iqbal Industrial City (M3) in Faisalabad, Rashakai Economic Zone on M-1 in Khyber Pakhtunkhwa (KP), China Special Economic Zone at Dhabeji (Thatta, Sindh) and model ICT zone in Islamabad.

4.4. CPEC and SEZs

In Pakistan, SEZs have once again acquired prominence in the policy circles since the inception of CPEC. Under this framework, the Chinese and Pakistani governments have agreed to enhance trade and industrial cooperation while developing infrastructures and establishing SEZs along CPEC route. During the first phase of CPEC projects, SEZs were proposed by the Ministry of Planning, Development and Reforms, nine SEZs were approved for all four provinces, Gilgit-Baltistan (GB), Azad Jammu and Kashmir and two at federal level. While the identified SEZs are currently at preliminary stage, however, during the 8th meeting of the CPEC Joint Cooperation Committee (JCC) held in December, 2018 in Beijing, both sides agreed to work jointly to develop these zones in a speedy manner.

As these SEZs are entering in the development phase, it is important to discuss both ideas and practices experimented in other countries in order to make SEZs successful tool to spur industrialisation in the country. This section mainly focuses on these practices in the light of the experiences of other developing countries and lessons learned from China, India, Bangladesh and Myanmar.

LEARNING FROM GLOBAL EXPERIENCES

As discussed in the previous section, many developing countries have established SEZs to foster economic development which was proved successful in achieving their objectives. Initially, majority of the zones were in industrial countries with first industrial zone established in Ireland in 1959 which were later adopted in developing countries, particularly, in Asia. According to the World Investment Report 2019, there exist more than 4,000 formally registered zones around the world. Most of the zones are concentrated in South-East Asia and the rest of them are present in Eastern Europe and the regions of Sub-Saharan Africa. There are some practices, positive and negative that has emerged from international experiences with SEZs. This study discusses them in the section below with the aim of seeking the best practices for Pakistan.

5.1. Business Environment

Under SEZs, the host countries provide fiscal incentives to attract domestic and foreign firms into the zones which include tax incentives, tax holidays and exemptions. Although the financial incentives are important factors for investors, they are not sufficient conditions for the firms to relocate them at the zones. This has empirically tested in Farole’s study in which the author, while using data from 77 countries, shows that enhanced infrastructure and trade facilitation contribute significantly to the success of a SEZ while financial incentives (like tax breaks) have no measurable impact in absence of the required business climate for investors (Lu and Yuan, 2010). It is, therefore, important that SEZ policy must go beyond these financial incentives while the focus should be to ensure better business climate for the prospective investors at the zones. This includes building the required infrastructures like gas and electricity supply at the zones along with providing ‘one-stops’ clearance service for the firms to operate at the zones.

China: China offered a 15 per cent corporate tax rate to the investors which were half than what the rate was outside the zones. Also, the firms operating at the zones were exempted from local income taxes (Farole, 2011).

India: India formulated a comprehensive SEZ policy in 2005 which was established by the SEZ Act. It is worth mentioning that India had experimented with SEZs prior to 2005 but, through 2005 Act, it formally expanded the uses of zones across the country.[1] Under this Act, India had offered 100 per cent tax exemptions for the first five years and 50 per cent for the next five years, but many analysts believe that despite these benefits, the zones have underperformed. Recent statistics show that investment and exports from the zones are 41 per cent and 25 per cent respectively which are far below than the projected rates.[2]

Bangladesh: The case of Bangladesh exhibits significant improvement in its business climate which is demonstrated by more foreign investors entering the country. The zones have attracted investment in labour-intensive sector like garment and textile as it has capitalised on its labour abundance. So far, Bangladesh’s zones have attracted more than US$12 billion in investments by more than 400 enterprises and annual exports from the zones average US$5 billion. This accounts for about 16 percent of Bangladesh’s aggregate exports.[3]

Myanmar: Myanmar has one zone—Japan-backed Thilawa SEZ—which is at the advanced stage of development and is considered as a success story. According to the official statistics, the total investment in Thilawa has reached more than US$1 billion with 78 firms from 16 countries investing in the area.[4] The details show that enhanced infrastructure and trade facilitation has got the attention of foreign investors to operate from this zone.

5.2. Lessons for Pakistan

Pakistan needs to create supporting business climate for foreign and domestic firms to invest at the specified zone. The state of Khairpur SEZ, as discussed in the previous section, is an example of non-functional zone due to poor business climate. While looking at the work structures of zones in other countries, it is observed that the governments have given authority to local governments to pass laws at the SEZs. However, in Pakistan, higher bureaucratic interventions with multiple interests of different stakeholders have made the existing (i.e., the Khairpur SEZ) zones redundant. This can be the case with the other SEZs prioritised under CPEC, if Pakistan fails to enhance the required infrastructure and ease the trade facilitation at the zone. It is also important to note that Pakistan has a weak legal regime, which is also a major hurdle to attract foreign investment in the country. Thus, Pakistan needs to offer strong arbitration rules in case of contract disputes. In this case, Pakistan could look at China’s experience which has drawn the arbitration rules from the West and currently experimenting them at the Shanghai Free Trade Zone.

POLICY EXPERIMENTATION

In order to strengthen the business climate, SEZs should promote policy experimentation. Pakistan can learn from the countries like China which had experimented with certain policies at the SEZs when it started its transition towards a more market-oriented economy. According to Acemoglu and North, strong institutions are necessary for economic growth. As per this perspective, strengthened property rights, reliable infrastructure and transparent regulatory framework are important factors for the firms to locate their business to certain zones. Yet, it is observed that the policy-makers face political economy constraints, making it difficult to bring reforms and implement better policies. Thus, through SEZs, the governments can experiment with new rules which can later be implemented in the rest of the country if the regulatory framework is effective. Pakistan can use its planned SEZs as laboratories for bringing the required economic reforms along with ensuring political and economic autonomy to the local management. With CPEC already entering in industrial cooperation phase, Pakistan can learn from best practices and experiences of China while experimenting with different framework to help grow Pakistan’s industrial sector. Once these SEZs are operational fully, it is important to assess the effects of policies being tested in the SEZs. This can be done through surveys of the firms and workers over time to track the performance metrics of employment, output and exports being generated at the zones.

SEZs AND SPILL-OVER EFFECTS

It is generally observed that SEZs are accompanied by technology and knowledge transfers for the host country. These create positive and negative externalities or productivity spill-overs for the firms operating outside the zone. However, it is important to keep in mind that these spill-overs need the right policies to have positive impact on the economy. Societal gains must exceed these costs. SEZs cannot solve the issue of unemployment unless the governments formulate better labour policies to be implemented at the zones. Taking the case of China and Bangladesh, it is observed that with right policies along with better business climate, these zones have generated employment opportunities in their respective countries; China’s four historical economic zones accounted for 2 percent of national employment, while in Bangladesh, the zones have generated more than 400,000 jobs, 0.5 per cent of national employment (Zeng 2015) In the long-run, SEZs generate externalities for the firms located outside the zones, by encouraging the firms to adopt better practices from firms operating inside the zones. As discussed in previous section, productivity levels of Pakistani manufacturing firms are low, therefore, it is important that the planned SEZs are able to generate positive spillovers for domestic firms from the zones. Here, it is pertinent to note that Myanmar’s SEZ law makes it mandatory for the firms operating in the zones, to shift their skilled labour force towards Myanmar’s citizen: 75 percent of the skilled workforce must be Burmese citizens after four years of operations (Amit, 2016). To further encourage skills development, the Thilawa SEZ has created a vocational institute to train workers and the institute should work closely with firms to learn what skills are in demand. For Pakistan, it is important to understand the overall dynamics of SEZs and its impacts on the broader domestic economy. The policy-makers need to have the knowledge of positive and negative externalities of SEZs and must formulate policies based on best practices of other countries. Successful SEZs are those that generate spill-overs and foster institutional reforms in the broader economy.

______________________________

[1] “The Special Economic Zones Act, 2005,” The Government of India.

[2] “Performance of Special Economic Zones,” An Optional Note, Comptroller and Auditor General of India (2014).

[3] Bangladesh Export Processing Zones Authority, (BEPZA).

[4] “ Success Story,” Thilawa SEZ Set to Launch its Second Phase as Announced by Set Aung, Deputy Governor of the Central Bank and Chairman of the Thilawa SEZ Management Committee.

CONCLUSION

Pakistan’s recent focus on SEZs, under CPEC, has the potential to enhance firms’ productivity, integrate Pakistan with global value chains and revive its manufacturing industry in the long run. While studying the state of Pakistan’s economy, this study finds that relative to its neighbouring countries like India and Bangladesh, Pakistan’s exports basket is comprised of intermediate and primary goods. The manufacturing sector is characterised by low levels of productivity and attracts low foreign investment into the country. Pakistan’s firms are less globally engaged than its neighbouring countries. Based on the global experiences with SEZs, this study emphasises that the development of SEZs must be aimed at improving the overall business climate in the country. This can be done through improved infrastructure and trade facilitation to attract investment by foreign and domestic firms in the zones. It further asserts that SEZs should be used as test-case tools in order to foster economic development in the country based on the experiences of other emerging economies. These would help in experimenting with different policies within the zones which could later be implemented in the rest of the country. To conclude, it is important that the planned SEZs, through spill-over effects, benefit the whole economy, workers and firms outside the zone. This is important in order to manifest that these zones are not isolated islands within the economy, but laboratories for experimenting with policies which foster economic development.

REFERENCES

Amit K. Khandelwal, (2016), “Special Economic Zones in Myanmar,” International Growth Centre.

Ali, M. M. & Faisal, F. (2016). CPEC, SEZ (special economic zones) and entrepreneurial development prospects in Pakistan. The Pakistan Development Review, 143-153.

Chen, J. (1993). Social cost‐benefit analysis of China’s Shenzhen special economic zone. Development Policy Review, 11(3), 261–272.

Farole, T. (2011). Special economic zones in Africa: comparing performance and learning from global experiences. The World Bank.

Hameed, R., Nadeem, O., Mayo, S. M., Ahmad, I., & Aziz, A. (2015). Constraints and prospects of relocating marble processing units in Ichhara, Lahore, Pakistan. Pakistan Journal of Science, 67(2).

Hussain, M., & Mehmood, S. (2018). Special economic zones and industrial parks under CPEC: Opportunities and challenges. Regional Studies, 36(2), 88–124.

Jayanthakumaran, K. (2003). Benefit–cost appraisals of export processing zones: A survey of the literature. Development Policy Review, 21(1), 51–65.

Kemal, A. R. (2006). Key issues in industrial growth in Pakistan. Lahore Journal of Economics, 11.

Khan, K., & Anwar, S. (2016). Special economic zones (SEZs) and CPEC: Background, challenges and strategies. The Pakistan Development Review, 203–216.

Khandelwal, Amit K. (2016) Special economic zones in Myanmar. International Growth Centre.

Lu, W., & Yuan, H. (2010). Exploring critical success factors for waste management in construction projects of China. Resources, conservation and recycling, 55(2), 201–208.

Naeem, S., Waheed, A., & Khan, M. N. (2020). Drivers and barriers for successful special economic zones (SEZs): Case of SEZs under China Pakistan economic corridor. Sustainability, 12(11), 4675.

Nigar, N. (2020), Special economic zones for growth and competitiveness in Pakistan’s economy: Learning from global experiences. Strategic Studies, 40(40).

Qayyum, U. & Nigar, N. (2020). An empirical analysis of Pakistan’s agriculture trade with China: Complementarity or competition? (No. 2020: 23). Pakistan Institute of Development Economics.

Qayyum, U., & Mahmood, Z. (2013). Inter-linkage between foreign direct investment and foreign trade in Pakistan: Are they complements or substitute? (No. 2013: 91). Pakistan Institute of Development Economics.

Tang, V. T. (2015). Does learning by importing, self-selection of markets and financial innovation matter for exporting firms in special economic zones?. Investment Management and Financial Innovations, 12(1), 198–206.

Zeng, D. Z. (2015). Global experiences with special economic zones: Focus on China and Africa. The World Bank.

Zia, M. M., Malik, B. A., & Waqar, S. (2018). Special Economic Zones (SEZs): A comparative analysis for CPEC SEZs in Pakistan. Pakistan J. Soc. Sci, 9, 37–60.