Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Pakistan’s New Tariff Policy – Long Overdue Strategy for the Future

Tariff is an indirect tax is levied on goods ultimately purchased by consumers. Being an important instrument of trade policy, it plays an imperative role in the efficiency of domestic industries. Pakistan started actively liberalizing its tariff regime in 2005 but the tariff structure is still full of complexities.

Recently National Tariff Commission (NTC) of the Ministry of Commerce has formulated a National Tariff Policy 2019-24 (NTP). The government has acknowledged the significance of imposing import tariffs for industrial development, export growth and competitiveness. The main concern was that in previous years, import tariffs[1] were used as a revenue generation but at present, the focus is on trade promotion and specifically that of exports.

NTP is designed to eliminate inconsistencies in the tariff structure. The purpose is to have a refined tariff policy which could display trade policy fortitudes and enhancement of competitiveness through duty-free access to imported raw material and promotion of investment in efficient industries. Based on tariff policy reviews, the NTP has adopted measures which include simplification of tariff slabs, gradual reduction in tariffs on raw material, intermediate goods and machinery. Moreover, following vertical consistency, customs duty (CD), regulatory duties (RD) are statutory regulatory orders (SROs) will be lowered in next five years at a gradual pace. Cascading tariff structure will be adopted where tariffs will increase with stages of processing of a product.

Under the policy, the difference in rates of tariff for the commercial importers and industrial users of raw material, intermediate and capital goods will be eliminated to provide arena for small and medium enterprises (SMEs) through competitive access to essential raw material. The nascent (emerging) industry will also be provided with time-bound strategic protection. The policy has been developed by the Commerce Division and will mainly be implemented through the Tariff Policy Board[1]. A tariff policy center will be created in the Ministry of Commerce, and it will serve as the secretariat of the Tariff Policy Board.

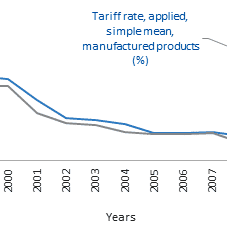

Based on data from the World Development Indicators database, a gradual reduction in tariff rates is observed in primary products as well as in manufactured products. This confirms Pakistan is doing efforts to achieve export competitiveness by reduction in tariffs, and the new NTP 2019-24 reflects this as well. Some thought provoking points regarding the policy are:

1. NTP has been committed for trade promotion instead of revenue generation which is expected to lead towards industrialization and competitiveness. The power to charge tariffs and impose regulatory duties will be transferred from the customs department to the Commerce Ministry. However, a regulatory issue may arise here and the new cell may take time to learn the intricacies of policies.

2. The tariff slabs will be simplified based on the principle of cascading; tariffs on raw materials, intermediate and capital goods will be gradually reduced; the additional customs duty and regulatory duties will be gradually reduced in the next five years. Vertical consistency is promised with cascading tariff structure where tariff will increase with stages of processing of a product. Given the fragile state of the economy and the need to boost industrial growth, the NTP should adopt gradual-to- progressive commitments.

3. The policy shows strong commitment for reductions that will be given through Trade and Investment policies. With the implementation of NTP, simultaneous timely measures should be also be introduced to avoid misconceptions in future. In this connection it is essential that the policy work in close coordination.

4. As the import tariff and SROs will be reduced gradually, there should be a reduction of price for consumer (of imported product) and they should be better off. This can be another feather in the cap of the government.

5. For making the industry competitive, quality concerns of local products must be addressed. Unfortunately the new policy makes no mention of which sectors might be the winners and losers. In the next step of NTP, government should select competitive industries on the basis of productivity and by assessment of value addition channels.

[1]Import tariffs are easily levied as compared to direct taxes.

[1] To be chaired by the adviser to the prime minister on commerce, with the minister of industries and production, finance secretary, revenue secretary, Federal Board of Revenue chairman, commerce secretary, Board of Investment secretary and National Tariff Commission chairman as its members.

Download full PDF