Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Pakistan Stock Exchange and the COVID-19 Outbreak (P & R Vol.1 Issue 1)

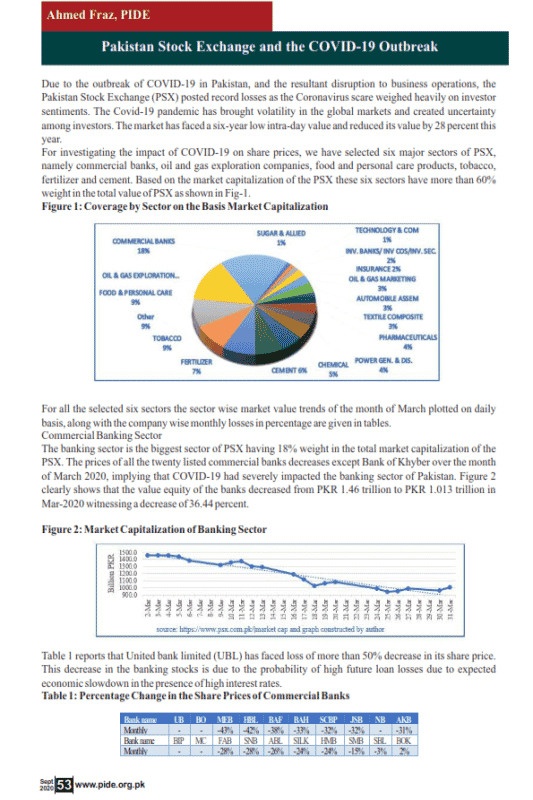

Due to the outbreak of COVID-19 in Pakistan, and the resultant disruption to business operations, the Pakistan Stock Exchange (PSX) posted record losses as the Coronavirus scare weighed heavily on investor sentiments. The Covid-19 pandemic has brought volatility in the global markets and created uncertainty among investors. The market has faced a six-year low intra-day value and reduced its value by 28 percent this year. For investigating the impact of COVID-19 on share prices, we have selected six major sectors of PSX, namely commercial banks, oil and gas exploration companies, food and personal care products, tobacco, fertilizer and cement. Based on the market capitalization of the PSX these six sectors have more than 60% weight in the total value of PSX as shown in Fig-1.

Figure 1: Coverage by Sector on the Basis Market Capitalization

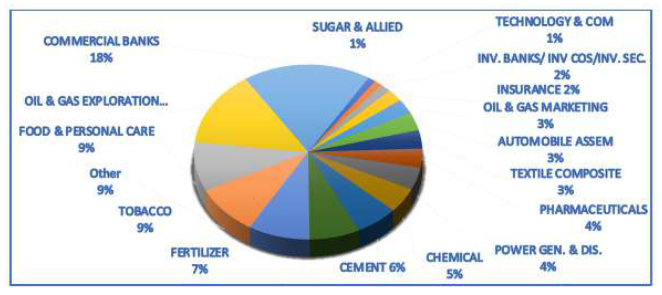

For all the selected six sectors the sector wise market value trends of the month of March plotted on daily basis, along with the company wise monthly losses in percentage are given in tables. Commercial Banking Sector The banking sector is the biggest sector of PSX having 18% weight in the total market capitalization of the PSX. The prices of all the twenty listed commercial banks decreases except Bank of Khyber over the month of March 2020, implying that COVID-19 had severely impacted the banking sector of Pakistan. Figure 2 clearly shows that the value equity of the banks decreased from PKR 1.46 trillion to PKR 1.013 trillion in Mar-2020 witnessing a decrease of 36.44 percent.

For all the selected six sectors the sector wise market value trends of the month of March plotted on daily basis, along with the company wise monthly losses in percentage are given in tables. Commercial Banking Sector The banking sector is the biggest sector of PSX having 18% weight in the total market capitalization of the PSX. The prices of all the twenty listed commercial banks decreases except Bank of Khyber over the month of March 2020, implying that COVID-19 had severely impacted the banking sector of Pakistan. Figure 2 clearly shows that the value equity of the banks decreased from PKR 1.46 trillion to PKR 1.013 trillion in Mar-2020 witnessing a decrease of 36.44 percent.

Figure 2: Market Capitalization of Banking Sector

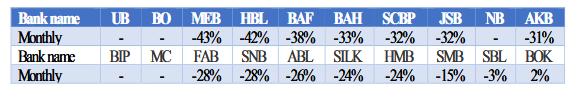

Table 1 reports that United bank limited (UBL) has faced loss of more than 50% decrease in its share price.

Table 1 reports that United bank limited (UBL) has faced loss of more than 50% decrease in its share price.

This decrease in the banking stocks is due to the probability of high future loan losses due to expected

economic slowdown in the presence of high interest rates.

Table 1: Percentage Change in the Share Prices of Commercial Banks

Oil and Gas Exploration Companies Sector

Oil and Gas Exploration Companies Sector

The oil and gas exploration is the second largest sector of PSX having 14% weight in the total market capitalization of the PSX. The prices of all the 4 listed companies in oil and gas exploration decrease over the month of March 2020. Figure 3 clearly shows that the value equity of the oil and gas exploration sector decreased from PKR 1.13 trillion to PKR 721.45 Billion in March 2020 witnessing a decrease of 44.65 percent. The COVID-19 had also severely affected this sector.