Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Falling Textile Exports

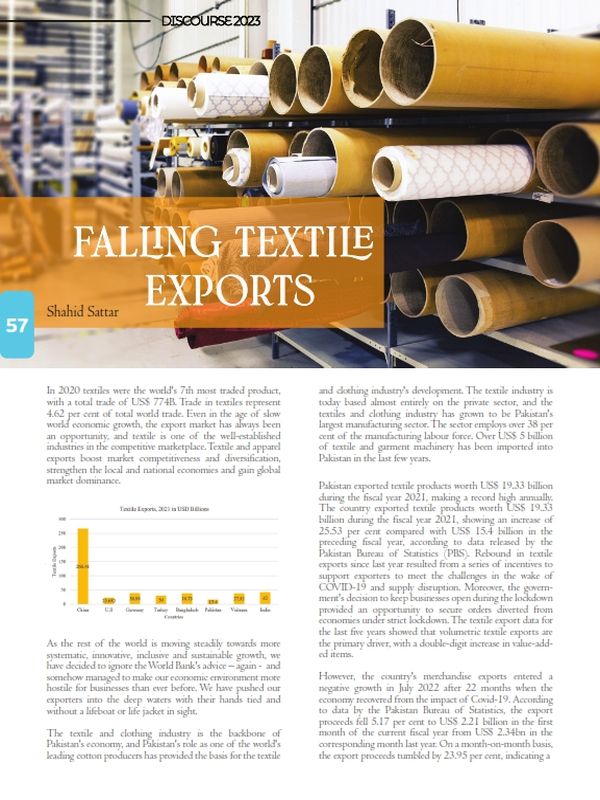

In 2020 textiles were the world’s 7th most traded product, with a total trade of US$ 774B. Trade in textiles represent 4.62 per cent of total world trade. Even in the age of slow world economic growth, the export market has always been an opportunity, and textile is one of the well-established industries in the competitive marketplace. Textile and apparel exports boost market competitiveness and diversification, strengthen the local and national economies and gain global market dominance.

As the rest of the world is moving steadily towards more systematic, innovative, inclusive and sustainable growth, we have decided to ignore the World Bank’s advice – again – and somehow managed to make our economic environment more hostile for businesses than ever before. We have pushed our exporters into the deep waters with their hands tied and without a lifeboat or life jacket in sight.

The textile and clothing industry is the backbone of Pakistan’s economy, and Pakistan’s role as one of the world’s leading cotton producers has provided the basis for the textile and clothing industry’s development. The textile industry is today based almost entirely on the private sector, and the textiles and clothing industry has grown to be Pakistan’s largest manufacturing sector. The sector employs over 38 per cent of the manufacturing labour force. Over US$ 5 billion of textile and garment machinery has been imported into Pakistan in the last few years.

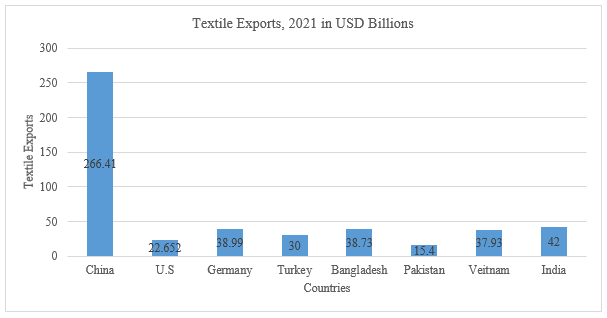

Pakistan exported textile products worth US$ 19.33 billion during the fiscal year 2021, making a record high annually. The country exported textile products worth US$ 19.33 billion during the fiscal year 2021, showing an increase of 25.53 per cent compared with US$ 15.4 billion in the preceding fiscal year, according to data released by the Pakistan Bureau of Statistics (PBS). Rebound in textile exports since last year resulted from a series of incentives to support exporters to meet the challenges in the wake of COVID-19 and supply disruption. Moreover, the government’s decision to keep businesses open during the lockdown provided an opportunity to secure orders diverted from economies under strict lockdown. The textile export data for the last five years showed that volumetric textile exports are the primary driver, with a double-digit increase in value-added items.

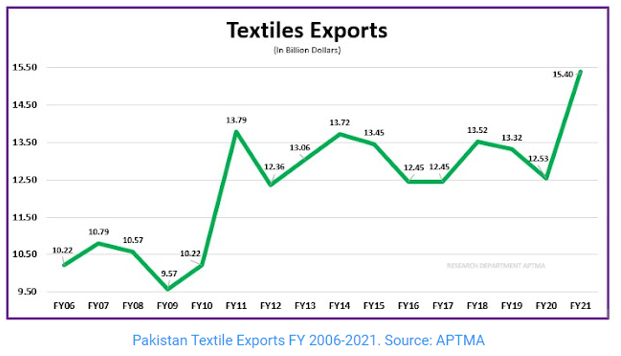

However, the country’s merchandise exports entered a negative growth in July 2022 after 22 months when the economy recovered from the impact of Covid-19. According to data by the Pakistan Bureau of Statistics, the export proceeds fell 5.17 per cent to US$ 2.21 billion in the first month of the current

fiscal year from US$ 2.34bn in the corresponding month last year. On a month-on-month basis, the export proceeds tumbled by 23.95 per cent, indicating a downward trend in the export sector, just as the increase before the current drop in exports is entirely volumetric.

The World Bank’s Pakistan Development Update, 2021, suggests that to sustain robust economic growth, Pakistan needs to increase private investment and export more. A key factor driving the trade imbalance is the declining export competitiveness. Its share of exports in GDP has been declining since the turn of the century, from 16 per cent in 1999 to 10 per cent in 2020.

According to Derek Chen, Senior Economist World Bank, the long-term decline in exports as a share of GDP has implications for the country’s foreign exchange, jobs, and productivity growth. Therefore, confronting the core challenges necessary for Pakistan to compete in global markets is imperative for sustainable growth.

In examining the country’s persistent trade imbalance, the report identifies critical factors hindering exports: high effective import tariff rates, limited availability of long-term financing for firms to expand export capacity, inadequate provision of market intelligence services for exporters, and low productivity of Pakistani firms. This falling export share affects foreign exchange, jobs, and productivity growth. At the firm level, the decline is consistent with low entry rates into exporting and exporters that struggle to expand over their life cycle. At the economic level, the lack of sustained robust growth in exports has resulted in negligible diversification or sophistication gains for the export bundle.

According to the latest World Bank annual ratings, Pakistan is already ranked 108 among 190 economies in the ease of doing business. With the increase in working capital levels and interest rates, business costs have increased to unsustainable levels, while the withdrawal of zero-rating sales tax (SRO1125) and the implementation of a seventeen per cent general sales tax on the export-oriented sector add to the injury. Inefficient tax policies inflate inventory and capital costs and encourage the trade volume to increase outside the tax system, resulting in fraud, smuggling and import of clothing.

For a country like Pakistan, going through energy crises with high costs and scarce resources, to increase productivity and ensure sustainable supply, resource allocation should be such that the priority of gas supplied to different sectors of the economy should be such that productive. Sectors of the economy that add more value to GDP should be given preferential priority as such policy measures enhance exports, boost competitiveness, encourage job creation and have a multiplier effect on value chains. However, Pakistan’s favouring domestic over industrial consumption is a classic case of prioritising short-term consumer satisfaction over long-term economic stability.

There is a dire need for pricing policy reforms for the inputs such as fertiliser, gas electricity. The export sector in Punjab is provided gas at 9 US$/MMBtu even under the Regionally Competitive Energy Tariff (RCET) in late 2018, while the basic household tariff is $1 and about US$ 2 on average per MMBtu. Similarly, gas prices for fertiliser start from 1 US$/ MMBtu, signalling a non–transparent and inefficient subsidy to the agriculture sector. In addition, some mills eligible for EOU power rates since 2019 are still denied concessional power tariffs even after cabinet and ECC approval despite a multitude of meetings, letters and commitments.

Due to the high price of inputs, the industry has already purchased raw materials at higher rates; at the same time, banks are not clearing import documents due to a lack of dollars in the country, with many mills having imports pending at various stages. Due to delay, the businesses are not only incurring exorbitant demurrage and detention charges, which the collector customs is refusing to waive, rendering textile exports uncompetitive in the process. A significant number of textile mills have also started to shut down due to non-maintenance and, consequently, a lack of spare parts.

The issue of raw material clearance from the ports remains unresolved owing to the unavailability of forex. Therefore, mills are currently unable to obtain cash against documentation and are closing down owing to the shortage of raw materials. Many mills are waiting for technology upgradation funds.

Though the textile industry maintains its ranking as the single largest manufacturing sector in Pakistan, unfortunately, indigenous manufacturing of its machinery could not develop along with the industry’s growth. Resultantly, demand for textile machinery is almost entirely met through global imports. The State Bank of Pakistan (SBP) announced a Long Term Finance Facility (LTFF) in 2016 to promote export-led industrial growth by providing subsidised financing for setting up export-oriented projects and modernising plants and machinery. However, the SBP has not yet approved the limit for long-term financing facilities, forcing manufacturers to retire their Letters of Credit for machinery at prohibitively expensive rates, as the markup allowed may render projects unfeasible. Textile machinery imports in Pakistan increased from around US$ 435 Million in 2020 to US$ 792 Million in 2021, reflecting around an 82 per cent increase from the previous year. It was reported at 5,615.000 PKR mn in October 2018, indicating capacity expansion and technological upgradation in the Pakistan Textile Industry.

With an investment of such sheer volume, Pakistan cannot afford to lose its principal industry. It contributes more than 67 per cent to the country’s total export earnings and accounts for about 46 per cent of total manufacturing. Its export capacity, if fully utilised, can produce an export of 26 to 30 billion US$ annually.

The author is a Former Member, Energy, at the Planning Commission and currently serving as Executive Director of the All Pakistan Textile Mills Association (APTMA).