Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

CTBCM: Delusion of a Market

The influence of political economy on decision-making is no secret, and the resultant skewed priorities have serious consequences for Pakistan’s economic growth. A number of competing interests are brought to the fold, and often the most flawed ones reign supreme. Our economy is industrializing and requires a sustainable growth plan, but instead we see frequent initiatives that are rarely seen to completion. These end up being discarded when a new, shiny opportunity presents itself, quite often backed by donor aid.

Before dissecting the Competitive Trading Bilateral Contracts Market (CTBCM) initiative and all that it entails, it is important to note something. Any new initiatives at this level are likely to have high costs, both economic and ideological, that outweigh potential benefits. There are a number of structural issues underscoring the power sector in Pakistan. Therefore initiatives such as CTBCM that idealize competition are not grounded in reality.

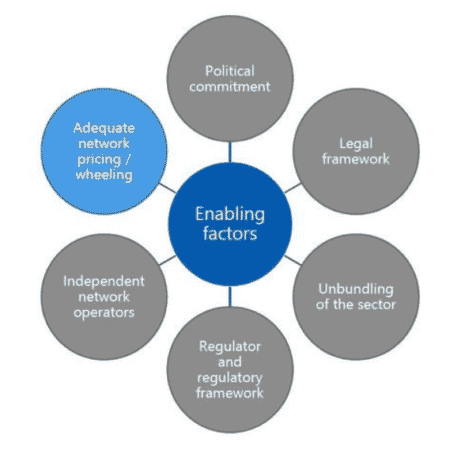

Pakistan presently has a single buyer model that purchases electricity from GENCOs and supplies to DISCOs. According to this model, the monopoly status of electric utilities does not incentivize efficiency. Instead it encourages the passing on of inefficiencies to consumers in the form of heightened tariffs. If Pakistan’s supply of electricity operates under a system of market discipline rather than a monopolistic regulation of government policy, the economy and end consumer will reap the numerous benefits of competitive markets. This, however, will not be a straightforward process as it requires the interplay of several factors.

This brings us to the issue with CTBCM. In 2015, the ECC approved a decision to introduce CTBCM for wholesale competition in the electricity sector. CPPA-G would act as the Market Operator, while NEPRA would promote competition in the generation and distribution sector. Transitioning to CTBCM entails NEPRA and CPPA-G working closely to establish CTBCM in their own capacities.

However, CTBCM has severe limitations, as the generation side is already completely tied up in long-term generation contracts. This renders distribution competition an irrelevant exercise, due to a complete lack of free suppliers in the foreseeable future. Some generation can be freed for competition through urgent re-negotiation of all PPAs of existing IPPs to guarantee 50% capacity. The balance can be traded or sold directly on B2B basis either through wheeling or from a power exchange.

It has been made clear that wheeling has been beyond the scope of NEPRA, as they were evidently unable to implement it. Therefore it is hard to imagine how they will undertake CTBCM. The proposal by CPPA of including irrational and unjustified costs in wheeling charges (including BPCs) was bound to obstruct the formation of free and competitive markets. In so doing it jeopardizes growth in employment, GDP and exports for Pakistan. All at a time when the power sector was close to signing MoUs with IPPs to start operating without capacity payments and other concessions to lower generation costs.

Meanwhile, CTBCM was formulated by a special group, under specific guidance underscoring vested interests. For instance, where would this development leave the openness of the retail market for energy? The first and most apparent pitfall of this system would be the subsequent abuse of monopoly power. It is likely to lead to cartel-like behavior of power producers in the wholesale market. This will lead to steep price increases and energy shortages. This was observed in the past in California, where capped retail prices caused large losses to DISCOs. There is also the example of Turkey, where state-owned GENCOs often undercut market price.

Furthermore, a costly generation mix is likely to arise, as wholesale prices will not decline sufficiently despite apparent competition. In contrast, a stable, fair and transparent policy regime would do well to attract the desired investment in generation.

As for the wholesale market, there is no free electricity at that level. Implementation of this plan will require the creation of a number of new organizations. Leaders will sit atop each, earning sizeable salaries with no real work to do. The role of private agendas, rent-seeking and political interventions is bound to reduce the feasibility of the project. It will allow it to be misused as an avenue for patronage as well as industry-bias.

The lack of regulatory bodies in Pakistan is the reason why initiatives such as this are allowed to run amok. LDCs have fewer resources and fewer qualified candidates to fill technical positions in regulatory agencies. In a study by Domah et al (2002), regulators in the median developing country had 30 to 34 staff compared to 53 in the median developed country. This despite having “three times the number of electricity users and three rather than two sectors to regulate”. The decision to undertake CTBCM will have grave consequences that are already apparent. The government is strongly urged to appoint an external consultancy to review the initiative in detail before it is allowed to take off. There must be a clear analysis of whether this is even an appropriate way to conduct market development in Pakistan’s environment.

It is a fact that the power sector bureaucracy is deeply entrenched in existing systems that have been beneficial for their vested interests. Pakistan’s energy crisis has persisted for decades, and power shortages are estimated to have cost the equivalent of at least 3-4% of GDP each year since 2008, in direct output losses alone. In addition, the impact on jobs has been severe, especially in the industrial sector. Furthermore, we must remain cognizant of the fact that electricity is perceived as a fundamental “right” and consumers are not willing to pay for it (Burgess et al., 2020). This notion coupled with our unreliable supply, poor service, and weak infrastructure translates into Pakistan’s energy sector being stuck in a “bad equilibrium.”

The political economy of the energy sector is so deep-rooted that its influence is apparent in every facet of the market configured by CTBCM. Their reluctance to forego their power and disrupt the status quo has widened the gaps between policy and implementation, and the sector’s long supply chain translates into split incentives. Every decision about a power system generates political benefits and costs that are often as critical as the technical and economic factors of projects. Foreign aid further upsets the balance, as government agencies receiving aid are able to increase their influence relative to other actors in the country, and thereby reduce accountability. As a concluding note on the efforts to hail CTBCM as a beacon of development, we must address the numerous underlying structural issues before we can reap the benefits of competition in this manner.

Download full PDF