Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

COVID-19 AND REMITTANCES (P & R Vol.1 Issue 1)

Foreign remittances are an important source of much needed foreign exchange in Pakistan. Remittances have helped the country in reducing the current account deficit and external debt burden. The COVID-19 crisis is feared to bring a decline in remittances to Pakistan. Recession in global market and international travel restrictions due to COVID-19, and the decline in the oil prices have led to a significant decline in remittance flows.

The Gulf region is a major destination for migrant workers and perhaps the largest source of migrants’ remittances to South Asian countries including Pakistan. Migrant workers are a large part of the GCC economies. Eighty per cent of the UAE population are foreign nationals. In Saudi Arabia, about 80 per cent of the labour force consists of migrant workers. Many of these overseas workers are employed as low-skilled workers in construction, hotels and restaurants and as domestic workers. For most of these workers, this is their only chance of employment and improving their lives.

At the same time the recipient countries benefit from the billion of dollars received as remittances from these countries. The collapse of the oil prices, tourism and full or partial lockdown are the three main channels through which COVID-19 has affected the GCC economies. Travel restrictions in the wake of the COVID-19 pandemic crisis have reduced global demand for oil, and the lack of a new production agreement between OPEC+ members has led to a flooding of the oil supply. As a result, oil prices have fallen by over 50% since the beginning of the COVID-19 crisis. The GCC countries are highly dependent on oil revenues and Saudi Arabia will suffer major loses if the virus affects the pilgrimage season.

The effects of COVID-19 and the fall in oil prices have had serious consequences for the GCC economies and could become even worse. It is expected that majority of the migrant workers in the GCC countries could lose their jobs due to a significant dent in the private sector economic activities. This means that many of these migrant workers will return to their home country and increase the masses of unemployment in the country.

Impact on the Remittances Flow to Pakistan

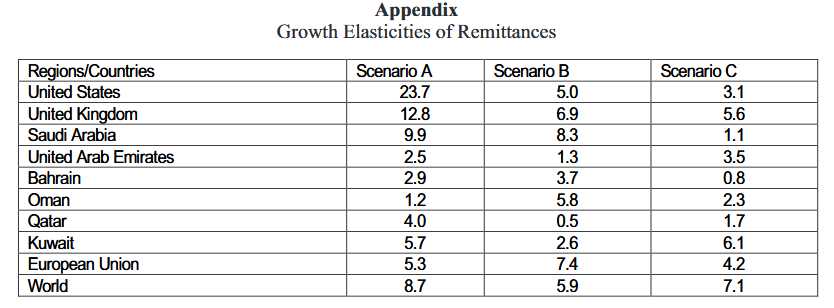

Recent data show that remittances accounted for more than 6% of Pakistan’s GDP in 2019. Remittances have increased from US$ 19.91 billion in FY18 to US$ 21.84 billion in FY19 (9.67% growth rate). With this growth, it was projected that Pakistan will receive around US$ 23 billion in FY20 and over US$ 26 billion in FY21. However, the unseen COVID-19 crisis and turmoil in oil market adversely impacted the flow of remittances to Pakistan. Quarterly data show that Remittances have declined from US$ 5918 million from Q2: Oct-Dec 2019 to US$ 5626 million Q3: Jan-Mar 2020, showing a 5% decline in last quarter (Figure 1). Among the GCC countries, Saudi Arabia and the United Arab Emirates are the largest source of remittances for Pakistan, and both these countries are under a lockdown. It would not be wrong to assume that Pakistan will have to forego the substantial contribution of remittances to GDP.

Given that the COVID-19 crisis is expected to have a major impact on the flow of remittances to Pakistan, the current Bulletin aims to quantify its magnitude.

Given that the COVID-19 crisis is expected to have a major impact on the flow of remittances to Pakistan, the current Bulletin aims to quantify its magnitude.

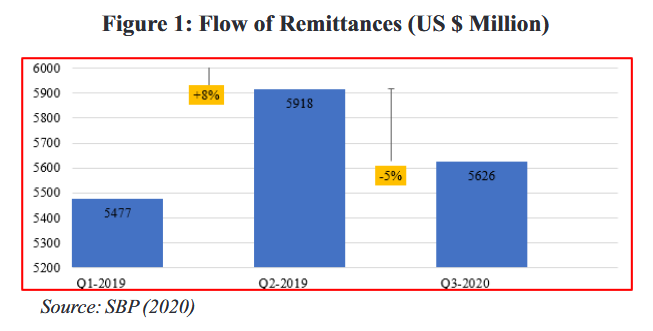

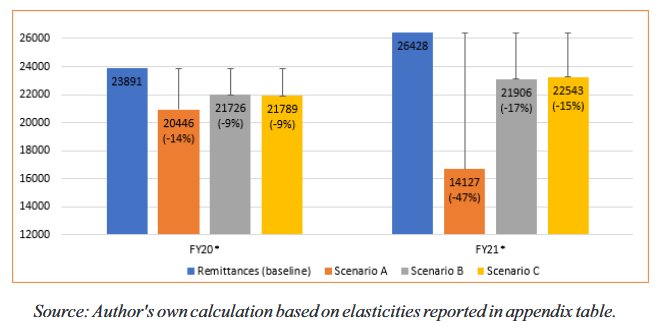

The projections of remittances are based on estimating their elasticities with respect to the GDP of the destination countries (see footnote 1 for details on this methodology). We consider three scenarios based on three time periods to project remittances:

Scenario A: growth elasticity of remittances is calculated using most recent year data i.e. 2019

Scenario B: growth elasticity of remittances is calculated using average growth rate of remittances and G D P in the short run (2017-19)

Scenario C: growth elasticity of remittances is calculated using average growth rate of remittances and GDP in the medium run (2015-19)

The projected remittances are given in Figure 2. Remittances will decline from 9% to 14% in the FY20. The FY20 estimates indicate that the remittances will likely vary between US$ 20446 million and US$ 21789 million. Using the same methodology, we find that the remittances, based on the three scenarios, will range between US$ 14127 million to US$ 22543 million for the FY21. It is equally important to note that there would be a significant decline in informal remittances, that constitute around 40% of the total remittances, due to restrictions on cross border movement of migrant workers as the flight operation is halted across the world. These restrictions would lead to at least 50% decline in informal remittances in FY21. The uncertain situation of the COVID-19 crisis leads to an extraordinary degree of uncertainty about the full global impact of the virus on the world economy. Therefore, the recovery of the remittances flows is highly uncertain and depends largely on economic recovery of the net remittances sending countries.

Millions of Pakistani migrant workers around the world are facing job losses, business closures and lockdowns. Many of them are no longer able to help poorer relatives in Pakistan, and the situation is feared to get worse with time. Remittances is the only source of income for the families of most of the migrant workers, therefore, the loss of the remittances is a serious threat to the well-being of millions of families in Pakistan. For many poor families, the loss of remittances is the loss of an important lifeline in funding and has a direct impact on nutrition, health and education outcomes.

Figure 2: Projections for FY20 and Fy21

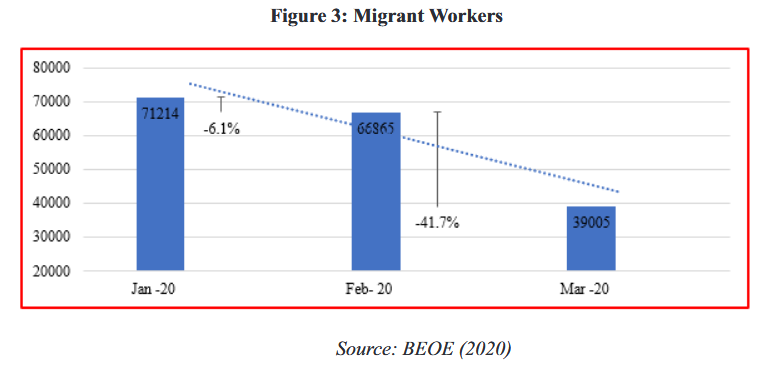

Linked to this are the employment dynamics which would result as a consequence of people returning and also not being able to find employment overseas. A significant decline in the outflow of migrant workers can pose employment challenges in coming years. The effects are beginning to show already. As figure 3 shows, migrant workers have declined from 71214 in January 2020 to only 39005 in March 2020. Massive decline in outflow of migrant workers will further worsen the future flow of remittances.

Linked to this are the employment dynamics which would result as a consequence of people returning and also not being able to find employment overseas. A significant decline in the outflow of migrant workers can pose employment challenges in coming years. The effects are beginning to show already. As figure 3 shows, migrant workers have declined from 71214 in January 2020 to only 39005 in March 2020. Massive decline in outflow of migrant workers will further worsen the future flow of remittances.

In the given scenario, government of Pakistan needs to bring its diplomatic missions in motion, lobbying with the host countries to treat Pakistani workers generously, and minimise the chances of being laid-off as much as possible.

In the given scenario, government of Pakistan needs to bring its diplomatic missions in motion, lobbying with the host countries to treat Pakistani workers generously, and minimise the chances of being laid-off as much as possible.

The other concern is that of the many money transfer networks have shut down. Host and home country authorities should treat remittance service providers as essential services and give them a waiver for any limitation on movement and closure of business.

References

Islam, R. 2002. Employment implications of the global economic slowdown 2001: Responding with a social focus (Geneva, Recovery and Reconstruction Department, International Labour Office).

Rangarajan, C., Kaul, I. and Seema, S. 2007. Revisiting employment and growth, in ICRA Bulletin-Money & Finance, Vol. 3, No. 2.

Timothy, R. and Sasikumar, S.K. 2012. Migration of women workers from South Ashia to the Gulf (New Delhi, V.V Giri National Labour Institute and UN Women).

Iqbal, N (2016) Labour migration from Pakistan: 2015 status report, International Labour Organization, https://www.ilo.org/islamabad/whatwedo/publications/WCMS_514139/lang–en/index.htm

World Bank. 2020. South Asia Economic Focus, Spring 2020: The Cursed Blessing of Public Banks.

Washington, DC: World Bank. © World Bank. https://openknowledge.worldbank.org/handle/10986/33478 License: CC BY 3.0 IGO.”