Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Reconfiguring Pakistan’s Economy

On a macroeconomic level, the Gross National Product of a country is largely a mix of household consumption (“C”), government consumption (“G”), Investments (“I”), and the difference of Exports (“X”), and Imports (“I”), the latter being effectively referred to as Net Exports (“NX”). At a macroeconomic level, a country can decide which component of the equation to focus on.

Emerging economies at early stages of their growth prioritise investments as that results in accumulation of capital over the years, which can then be utilised for production, and eventually increasing overall aggregate supply in an economy. A spillover effect from investments is also in exports, as export-oriented investments can provide the necessary stimulus for increasing exports.

As the economy moves along its growth trajectory, it strives to maintain a positive balance between exports and imports, such that its growth may not be constrained by rising imports, which may lead to an outflow of resources from the country. Economies over the years continue to experiment between various configurations, sometimes even disincentivising investments, and incentivising consumption to attain economic growth, and so on. The key operating term being balance – the right balance among the different components of GNP can enable an economy to attain sustainable growth.

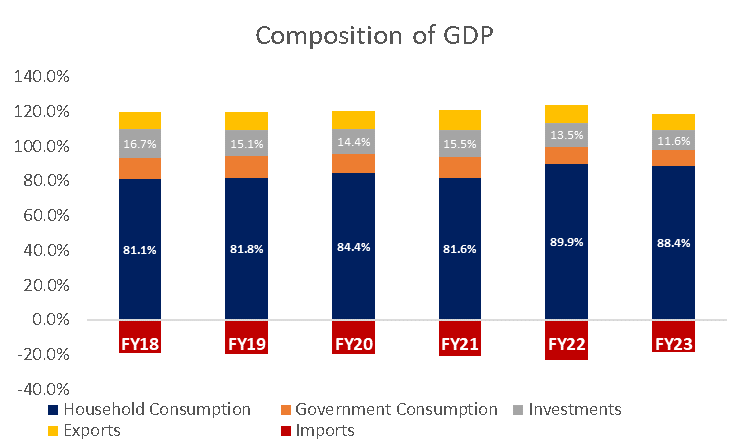

In the case of Pakistan, over the last many years, the economy has been heavily dependent on consumption. As per data published by the State Bank of Pakistan, total consumption made up 87.6 percent of the GNP, split between household consumption, and government consumption. The same has fluctuated in the range of 81-97 percent over the last many years. Such high levels of consumption leave little room for investments or exports – as the same is financed by increasing levels of imports, effectively keeping the Net Exports component of the GDP composition, consistently negative. As the economy effectively consumes more than it produces, it has to rely on imports to balance the equation. As consumption continues to increase much beyond existing aggregate supply, it has to rely on increasing imports. However, an economy cannot run in perpetuity on imports, because those imports need to be financed with foreign currency – and a time comes where foreign currency reserves deplete. An economy can borrow foreign currency to keep paying for imports, but ability to borrow diminishes, and the same cannot be done in perpetuity.

This is precisely why over the last decade, Pakistan has fluctuated between boom-bust cycles. Availability of foreign currency liquidity finances consumption, which accelerates GNP growth. However, as the growth is largely due to consumption, which is financed by imports, as soon as foreign currency reserves start depleting, the ability of the economy to support imports also starts to erode. This results in a downward pressure on the currency, as the demand for foreign currency (due to higher imports) far outweighs the demand for local currency (due to stagnant exports). As the currency depreciates, and as the economy is dependent on consumption, any shortage of foreign currency results in inflation, followed by a massive correction in both fiscal, and external positions. As things settle, and no structural changes are made, yet another infusion of foreign currency kick-starts a growth spurt till the time we lose out on foreign currency reserves again. The cycle continues to repeat till the time the ability to borrow diminishes, and the economy starts contracting, because the consumption cannot be financed by imports anymore.

Multiple boom-bust cycles over the last decade has not resulted in any serious thought regarding modifying the structure of the economy, which is heavily dependent on consumption. There exists a strong case to transition from consumption-oriented growth to investment-oriented growth, similar to the growth trajectories assumed by other lower middle income, and middle income economies over the years. The Investment-to-GDP ratio for Pakistan during the last ten years has averaged at 13 percent, meanwhile the same for South Asian countries is at 30 percent, and for lower middle income countries is at 28 percent. Inability of Pakistan to increase formal investments, which is a function of formal savings has led to a scenario where the economy has become highly consumption dependent. This also constrains the ability of the economy to achieve growth rates in excess of 4-5 percent per annum – because any growth is largely driven by consumption, and the same cannot be sustained if foreign currency reserves run out, as imports cannot be financed.

In order to attain sustainable growth, the nature of the economy needs to be reconfigured. There needs to be an effort to increase investments, particularly in export-oriented areas, that can increase exports, and gradually move towards the economy to a position where it is able to generate trade surpluses. Such a reconfiguration would enable the economy to accumulate foreign currency reserves and gradually attain macroeconomic stability. Increasing investments can be done through either increasing formal savings, or moving capital from informal economy, to the formal economy. In a scenario where such reconfiguration isn’t done, the country will continue to oscillate between boom-bust cycles, with the gap between each cycle shortening – eventually leading to a situation where economic growth may stagnate. As population continues to increase, stagnation of economic growth would be erosion of per capita income, as well as purchasing power, resulting in increased levels of poverty, and macroeconomic instability.

Any economic revival plans that are formulated by the government never take into consideration the composition of the GNP – and how the structure of our economy has been consumption oriented. There needs to be a long-term focus on investments, supported by an industrial policy that encourages and incentivises export-oriented growth. It can only be through such a reconfiguration of the economy that Pakistan may be able to attain sustainable growth rates, such that overall per capita incomes can steadily increase. Without such reconfiguration we may remain stuck in a low-growth loop, followed by bursts of growth financed by availability of foreign currency liquidity. A radical restructure is required, if we want any glimmer of hope for sustainable growth.

The author is an independent macroeconomist. He can be found on Twitter as @rogueonomist.