Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Textiles Losing the Plot

Pakistan’s policy makers have been consistently formulating excellent policies to address challenges in the industrial sector of the country, but these have been fruitless due to non-continuity and lack of implementation (Khan 2016). While some policies may yield short-term benefits, but to gain traction, they often lack sustainability in the long term. To navigate the complex and rapidly changing landscape, the textile industry can be viewed through the 5Fs framework. This framework enables companies to analyse the entire value chain, from Farm to Fibre to Factory to Fashion to Foreign stages, and identify areas of strength and weakness to stay competitive. It is particularly relevant in a market where consumer preferences, technology advancements, and sustainability considerations are paramount. We will examine this article through the lens of the 5Fs framework to identify issues and problems within the sector and enable the formulation of policies for mitigating the issues so identified.

Farm:

Lack of fibre (cotton and PSF, i.e. polyester staple fibre) have reduced or closed operations of many factories as both these fibres were to be imported in large quantity in an environment where L/C’s were not being opened or honoured. This brought to focus the extremely urgent need for establishing a reliable local supply of cotton and PSF in order to avoid such situations in the future.

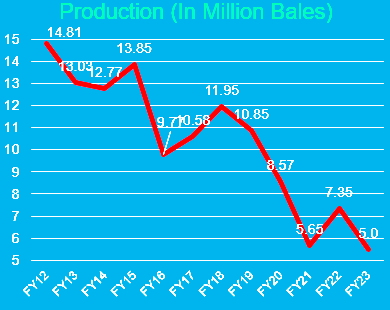

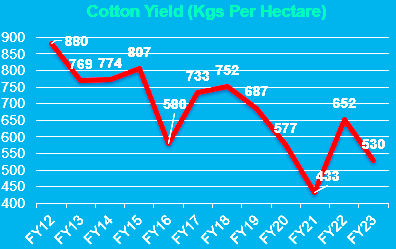

Pakistan’s cotton farming, which is crucial to the textile industry, is facing daunting challenges due to climate change, rising temperatures, unpredictable rainfall, and water scarcity – which are resulting in lower crop yields and diminished quality. As a consequence, cotton production and productivity has reached a 40-year low. This situation not only jeopardises the livelihoods of farmers but also threatens the sustainability and profitability of the entire textile industry.

Source: APTMA

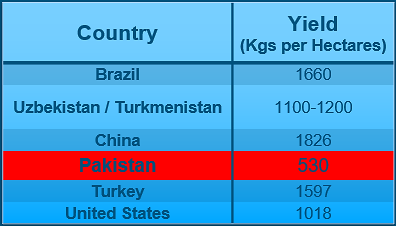

Pakistan’s low cotton yield and production costs the country approximately USD 4.0 billion annually, along with a much higher impact on GDP. Imports of cotton worth USD 5.0 billion in the past three years highlight the need for increased domestic production to reduce reliance on imports and lower the cost of edible oil imports as an important by-product of cotton is oilseed.

Despite challenges, some progressive cotton farmers achieve a yield of 1500 kg/hectares, emphasising the potential for improvement in productivity. This highlights the potential gains that can be achieved through better seed and crop management. Support for edible oil crops and addressing productivity issues are crucial for the cotton industry.

To ensure the long-term sustainability of the textile industry, Pakistan must prioritise the adoption of suitable seed varieties for the sector. By doing so, the country can secure the future of its textile industry and mitigate the adverse impact of climate change on cotton farming.

Fibre:

Ensuring the availability of adequate raw materials/fibre for Pakistan’s textile production is crucial for sustained growth, requiring measures such as promoting domestic cultivation, exploring alternative sources, and fostering international collabourations. Textile mills in Pakistan are instrumental in the cotton-to-fibre transformation, supporting high-quality textile production. To sustain growth and expand market opportunities, the industry needs to tap into the global synthetic textiles market by aggressively entering the industry and accessing raw materials at competitive prices. However, challenges such as high protection rates and tariff structures hinder Pakistan’s progress in the synthetic textiles sector. The government may implement trade facilitation measures by abolishing import duties on PSF, enabling the industry to diversify and thrive in international markets.

In terms of sustainability, some textile mills in Pakistan are taking proactive steps to promote eco-friendly practices. They are introducing innovative fabric ranges, such as Radianza fibre, which employs environmentally friendly dyeing processes to reduce water consumption and pollution. Additionally, larger companies are championing recycling and reuse by offering recycled textile products like “Premium,” “Indigo,” and “Blue,” which are made from post-industrial, pre-consumer, and post-consumer waste, respectively. By reducing the carbon footprint through these recycled products and developing biodegradable polyester, the textile industry in Pakistan is contributing to a more sustainable and environmentally conscious future. However, an increased R&D in this area is required which definitely requires an increased budget.

Unconventional materials such as Hemp and Banana leaves are increasingly being used in textiles due to their sustainability and eco-friendliness. These natural materials offer durability, breathability, and biodegradability, making them attractive alternatives to traditional textiles. Pakistan should also invest in such innovative yet sustainable fibres.

Factory:

Investing in human capital is vital for the industry’s sustainability. Ongoing training and education for textile workers and engineers are essential to stay updated on technology and production advancements. The industry also offers vocational training to attract young individuals into the field.

Efforts to modernise textile factories and enhance working conditions in Pakistan should be the top most priority. The government needs to focus on policies for energy efficiency and cost reduction, while private investors may invest in advanced machinery and technology to improve production efficiency and quality.

Enforcement of labour laws, strengthening of labour inspections, and protection of workers’ rights is a prerequisite for an exporting industry. Effective implementation of the 27 labour and human rights conventions is crucial as Pakistan’s current GSP plus status will be reviewed in December 2023. Factory owners should commit to reform and implement the requisite conventions. Revisions to labour laws, impartial investigations, and increased resources for inspections are needed. Transparency, collective initiatives, and grievance redressal procedures should be implemented by companies to improve the situation.

The infusion of approximately USD 5 billion in the textile sector served the objective of enhancing textile exports to reach USD 25 billion by 2025 through the establishment of 100 new textile units, accompanied by significant upgrades in value addition to meet market demands. Regrettably, so far, the investment has failed to achieve its potential due to various factors. These factors include difficulties in opening letters of credit (L/Cs), challenges related to the supply and pricing of energy (both gas and electricity), the high policy rate (currently standing at 21%), liquidity crises, complications regarding cotton imports and the release of shipments, obstacles concerning the refund of sales tax, and issues associated with the markup rates of the Long-term Financing Facility (LTFF).To ensure the success of such policies and investments, it is crucial to adopt a comprehensive approach that encompasses the enhancement of capacity in all relevant areas, enabling the policy to yield fruitful results.

Fashion:

Pakistan’s rich culture is rooted in the traditions and history of its people, showcasing a unique way of life, ideas, and ethics. The clothing in Pakistan, influenced by its diverse regions like Punjab, Sindh, Balochistan, Khyber Pakhtunkhwa, Kashmir, and Gilgit Baltistan reflects the cultural heritage of these areas. The clothing culture and fashion is a significant aspect that distinguishes each regional culture, incorporating elements of climate, lifestyle, and distinctive styles that contribute to their distinct identity. Despite this beautiful diversity, Pakistan’s fashion industry has not exploited its true potential as of yet. The fashion products and apparel industry are expected to exhibit dynamism and diversity. Despite challenges, the country’s textile industry holds significant potential to become a global fashion player. Abundant raw materials and a skilled workforce position Pakistan as a major producer and exporter of high-quality fashion products.

Investment in design and marketing is crucial to enhance the visibility and appeal of Pakistani fashion products. To address the perception of mediocre quality associated with products from Pakistan, manufacturers and designers should concentrate on creating innovative designs that appeal to a specific niche. This niche refers to a targeted segment of consumers who are willing to pay a higher price for textile products from Pakistan when they perceive added value, such as superior craftsmanship, unique aesthetics, or exclusive materials. By catering to this discerning niche market abroad, the textile industry in Pakistan can achieve higher profitability and overcome negative perceptions. Effective marketing campaigns and initiatives are necessary to promote Pakistani products successfully and maximise their market reach and impact. Pakistan’s textile industry has the potential to establish a strong foothold in the Western fashion sector. To capitalise on this opportunity, immediate implementation of effective marketing campaigns is essential.

Foreign:

With strategic investments and initiatives and sustained policy implementation, the industry can thrive. Trade barriers, such as tariffs, hinder Pakistan’s textile exports. In order to align our exports with global requirements, the government must undertake a thorough policy review. This should involve negotiating free trade agreements and expanding market access to ensure that our products can effectively compete on the global stage. By doing so, we can enhance our export potential and effectively meet the demands of the international market. It is also necessary to establish Pakistan as a reliable and quality supplier. Research and development investments are crucial to meet market trends and standards.

The global market for textile fibres has witnessed a shift from cotton to synthetic fibres, particularly polyester, with Pakistan’s textile industry lagging behind in this transition. The country’s garment exports still predominantly rely on cotton, and the use of man-made fibres remains limited. China, India, and Southeast Asian countries dominate the production and export of synthetic textiles. While a fully integrated chemical industry is crucial for synthetic fibre production, countries like Vietnam, Bangladesh, and Cambodia import materials to excel in the global market. Unfortunately, domestic import policies and market conditions have hindered Pakistan’s progress in the synthetic textiles sector, despite the potential. Removing import duties on PSF is essential to compete globally as bulk of PSF based textile manufacturers do not have access to duty free schemes for import and export. To stay competitive, the industry must prioritise enhancing productivity, efficiency, and quality.

Investing in sustainable and ethical practices across the 5Fs framework is vital for Pakistan’s textile industry to compete globally. This involves adopting organic and recycled fibres, conserving water and energy in factories, ensuring fair labour practices, and minimising waste in the supply chain. Not embracing sustainable and ethical practices in Pakistan’s textile industry carries severe consequences. Failing to meet evolving consumer demands may result in business loss, while exploiting workers and causing environmental harm can lead to legal and reputational repercussions for the industry.

Value addition in Pakistani textile businesses, through the shift to higher value-added products, such as finished garments and designer textiles, will enhance global market share, lead to increased revenue and establish Pakistan as a reputable hub for quality textile manufacturing.

Pakistan’s textile sector must embrace change, harness innovation, and establish itself as a trusted source of textile products. By taking collective action and implementing proactive measures, the industry can secure its rightful place and unlock its true potential.

Way Forward:

In order to strengthen exports and empower the economy, several crucial measures need to be undertaken:

1. Strengthening the Farm stage:

a. Promote research and development leading to usage of genetically modified seed varieties which are resistant to pests, water scarcity, have high heat tolerance etc.

b. Implement sustainable practices in cotton farming to mitigate climate change impacts.

c. Adopt innovative technologies like precision agriculture to improve crop yields and quality.

2. Enhancing the Fibre stage:

a. Prioritising enhanced R&D for identification of better quality and different raw materials.

b. Duty exemptions and duty drawbacks with more streamlined mechanisms are needed to support the industry and enable growth in the global synthetic textiles market.

3. Upgrading the Factory stage:

a. To prevent the futility of isolated policies, it is necessary to formulate all-encompassing policies for the textile sector that integrate with related sectors like gas and electricity, while ensuring effective implementation for true success.

b. Improve energy efficiency in textile factories.

c. Invest in modern machinery and technology for textile mills.

d. Stricter enforcement of labour laws, ensure compliance with international quality and safety standards.

e. Implement transparency, collective initiatives, and grievance redress procedures.

f. Focus on skill development and education for textile workers and engineers.

4. Promoting the Fashion stage:

a. Invest in design and marketing to enhance the visibility and appeal of Pakistani fashion products.

b. Focus on innovative designs and products to attract a different but profitable niche.

c. Conduct effective marketing campaigns and initiatives to showcase high value of Pakistani products, breaking away from the perception that Pakistan is merely a supplier of mediocre goods.

5. Expanding in the Foreign market:

a. Negotiate free trade agreements and expand market access.

b. Invest in research and development to meet market trends and standards.

c. Work towards establishing Pakistan as a reliable and quality supplier.

d. Enhance productivity, efficiency, and quality to stay competitive.

6. Embrace sustainable and ethical practices across the 5Fs framework:

a. Adopt organic and recycled fibres.

b. Minimize waste in the supply chain.

7. Shift towards value-added products:

a. Focus on producing finished garments and designer textiles.

b. APTMA’s commitment to establishing 1000 garment plants with a substantial investment of USD 7 billion has the potential to bring significant value addition to Pakistan’s textile sector and the overall economy. The boost in exports, job creation, technological advancement, value chain integration, infrastructure development, and sustainable growth are some of the key benefits that can be realised through this initiative. However, sustained policy support is essential to maintain this momentum and overcome any past challenges, ensuring the long-term success of the textile industry in Pakistan.

8. Continuously innovate and upgrade:

a. Harness innovation to meet evolving consumer demands.

b. Participate in international fairs and exhibitions to showcase capabilities.

c. Take collective action and implement proactive measures for industry-wide growth.

d. Create a strong linkage between academia and the textile industry which will foster continuous innovation and upgrades, driving advancements and ensure a dynamic and progressive sector.

Pakistan’s textile sector, with less than 2% global market share, has great potential for expansion; however, Pakistan must focus on a visible shift to more MMF based products as 70% of the world trade now focuses on MMF based fabrics. To revive the economy, sustainable practices across the 5Fs framework are crucial. Uplifting MMF import duties, enhancing the PSF sector, simplifying import-export schemes, promoting sustainable sourcing, eco-friendly production, innovation in design, and exploring new export markets is mandatory. Pakistan can become a prominent textile player, creating jobs, boosting foreign exchange, and driving economic development.

The authors are affiliated with the All Pakistan Textile Mills Association (APTMA).