Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

The Poor State Of Financial Markets In Pakistan

The Poor State of Financial Markets in Pakistan

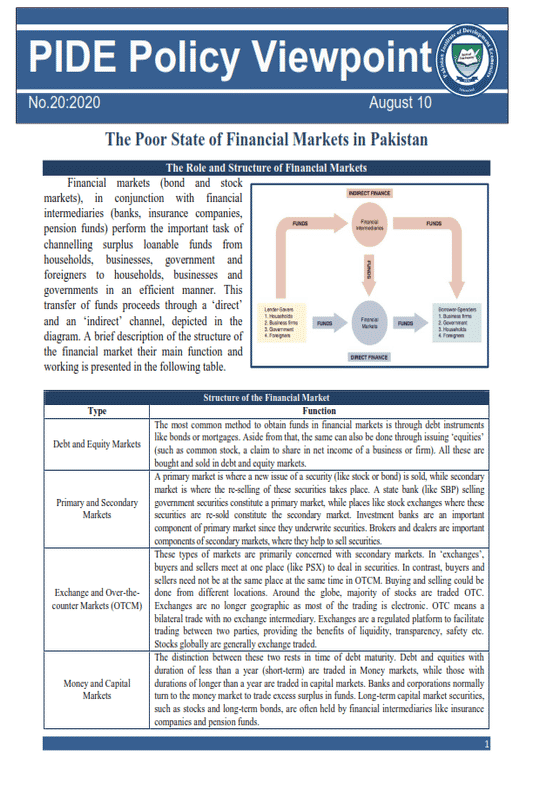

The Role and Structure of Financial Markets

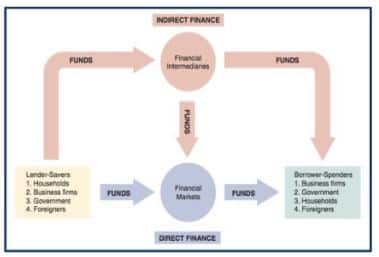

Financial markets (bond and stock markets), in conjunction with financial intermediaries (banks, insurance companies, pension funds) perform the important task of channelling surplus loanable funds from households, businesses, government and foreigners to households, businesses and governments in an efficient manner. This transfer of funds proceeds through a ‘direct’ and an ‘indirect’ channel, depicted in the diagram. A brief description of the structure of the financial market their main function and working is presented in the following table.

Financial Markets are Important for Growth

In 1858, British Prime Minister William Gladstone expressed the significance of financial markets in the following words: “Finance is, as it were, the stomach of the country from which all other organs take their tone”. Significant research exists to indicate that there is a direct relationship between the development of financial markets and economic growth. Whether it’s a firm level, industry level or cross country study, the positive effects of the growth of a well-functioning financial market on economic growth is well established.[1]

Financial markets are also a source is price discovery and transparency in corporate governance through listing and disclosure requirements. One of the major issues, information asymmetry between buyers and sellers, is partly resolved through well-functioning financial markets. Various products (bonds, stocks, derivatives like futures, options, swaps, etc., and bank CDs) are designed to suit the particular objectives and risk tolerance levels of investors. Larger and deeper financial markets result in provision of more liquidity to market participants, while smaller markets tend to be short on liquidity, with higher liquidity premiums.[2]

In order to assess how financial markets have performed in Pakistan over time, an analysis of its various components needs to be made. The following paragraphs present a brief overview of these.

Stock Market Remains Underdeveloped

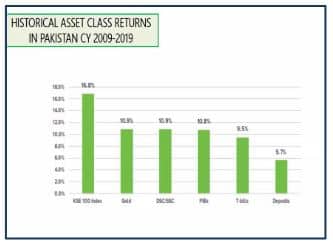

Stock market remains significantly under-developed in Pakistan despite 70 years of efforts and technical assistance from various aid agencies. Although stock market’s returns in Pakistan have been higher than other asset classes, not even a percent of Pakistan’s population invests in the stock market! The numbers of investors stood at a sorry 236,000 at end Dec 2019, out of a population of 220 million.[3]

Total capitalisation stands at a Rs 7.3 trillion, with average daily stock turnover in regular market standing at 208 million trades in March 2020.[4] However, looked at from monthly trading volumes, there can be significant variations. For e-g, trade volume stood above 460 million shares on 5th December 2019, dropped below 200 million as Covid-19 struck, and then rose again to 467 million shares on 9th July 2020.[5] The total number of stock brokers stands at 284.[6] Stock market capitalisation at the end of June 2020 was 15.6 percent of Pakistan’s nominal GDP, which is significantly less when compared with developed nations, and even lower than peer countries in terms of similar per capita levels. For e-g, in Bangladesh, the ratio stands at approximately 30 percent.

__________________________

[1]For example, see Levine, Ross (2004) ‘Finance and Growth: Theory and Development’; Levin, Beck and Asli (2004) ‘Finance, Inequality and Poverty: Cross-country Evidence’; Lopez and Spiegel (2002) ‘Financial structure and macroeconomic performance over the short and long run’.

[2]Levine, Ross (2004) ‘Finance and Growth: Theory and Development’.

[3]In China, the number stands at approximately 100 million. In Iran, the number currently stands at 8 million.

[4]‘5 year progress report’, PX, available at https://dps.psx.com.pk/progress-report.

[5]‘SECP measures well received by Capital Markets’, BR, 10th July 2020.

[6]PSX.

The number of listed companies, worryingly, has remained stagnant or falling over the last 5 years. At the moment, there are 531 listed companies, compared to 638 in 2012. There was only one Initial Public Offering (IPO) last year, compared to the average of about 25 in the 1990s.[7] Its performance tends to be heavily reliant on the decisions of the central government, especially what it announces subsidies and ‘relief’ packages. Textile related industries (Composite, Weaving, Spinning) constitute the largest share of listed firms on PSX at 25 percent of the total (i.e., 132 firms).[8] But it is heavily reliant upon taxpayer money sponsored bailout and support packages. Despite the support and presence of largest number of firms, this sector’s market capitalisation stands at a disappointing 3 percent of the total (i.e., Rs 189 billion).

Issues Hampering Growth of Stock Market

The stock market is dominated by a few large brokerage houses, and their actions have a substantial effect upon the performance of the PSX.[9] There is a strong perception among investors that a few influential brokers still call the shots despite separation of ownership and management at PSX.[10] Moreover, it is thought that insider information issue is not properly regulated, leading to retail investors being preyed upon.

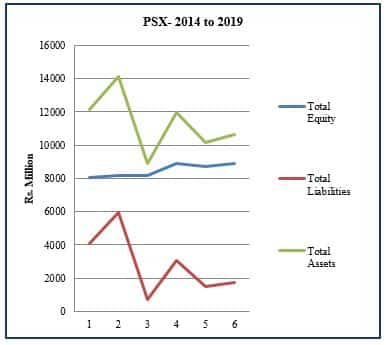

Only 30-40 percent companies are providing 80-90 percent liquidity to the market. More than 60 percent of market capitalisation in the PSX, for example, comes from only 5 sectors (out of a total of 34). The total liabilities of PSX (as a company listed on the exchange) have witnessed an upward trajectory, the total equity has remained stagnant while total assets have been declining.[11] During the same time period, expenses of the company as percentage of revenue increased from 81 percent to 93 percent.[12]

Firms that belong to families tend to be averse to listing at PSX for various reasons (fear of predatory taxation, onerous corporate governance requirements like audits and disclosures, etc.), and revert to banks rather than gaining required capital through listing. This explains one major reason for lower number of companies on PSX. Anchor investors including three Chinese Exchanges hold a 40 percent stake in PSX but marked improvements in the performance of various participants are still wanting. Despite PSXs best efforts to educate a wider populace, stock market participation still remains at less than a percent of the total population.

_____________________________

[7]‘Delisting signals a lack of faith in the market’, Dilawar Hussain, DAWN, 3rd February 2020.

[8]Data on PSX taken from https://dps.psx.com.pk/sectors.

[9]‘How those big stock brokers are breaking the market’, Mansoor Ahmed, The NEWS, 22nd June 2019.

[10]‘What’s keeping PSX investors away?’, Dilawar Hussain, DAWN, 16th September 2019.

[11]Source: PSX.

[12]Source: PSX.

Banks, Insurance and the ‘Play Safe’ Approach

Banks and insurance companies are two major components of financial markets. Theoretically speaking, banks channel deposits into the economy through lending, which expands the scope and size of the capital markets, primarily through credit invested into stocks and equities. The growth of capital markets, in turn, lowers the risk of bank equity capital, allowing banks to earmark extra capital needed for additional risk taking.[13] Insurance companies are considered a significant part of financial markets stability courtesy of their investment in financial market instruments, and the fact that they do not face the same kinds of systemic risks as banks, thus imparting a certain degree of stability. Further, their participation indirectly ensures the participation of the population that is insured, thus deepening the reach of financial markets.[14] Their role has also been termed as important in terms of providing market liquidity in adverse economic situations.[15]

In Pakistan’s case, however, one does not witness any pronounced participation by these two in financial markets. Both of them tend to exhibit the ‘play safe’ approach. Banks rely heavily on the public sector rather than financial markets. Raising profits through T-bills and PIBs is one of the major parts of banks’ assets, with lending amounting to 50 percent of total deposits on average. At the end of June 2019, 83 percent of banks’ total investments were in T-bills and PIBs.[16] From January 2019 to December 2019, banks’ credit to the government sector increased by a whopping 93 percent (from Rs 3 trillion, 486 billion to Rs 6 trillion, 728 billion).[17] Similar numbers are absent when it comes to taking recourse to financial markets.

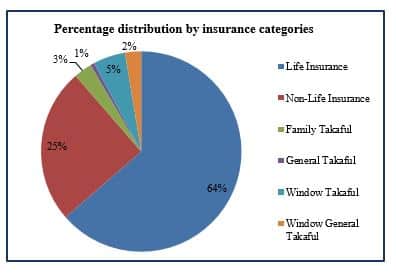

A somewhat similar case exists as far as the insurance industry is concerned. Pakistan’s insurance penetration and coverage is one of the lowest in the world, standing at 0.9 percent of the GDP. At present, there are 36 insurance companies of which seven exclusively deal with life insurance. These seven companies realise 63 percent of the gross premiums of the industry, whose size stands at an estimated Rs 308 billion.[18] The insurance is mainly concentrated on life insurance, and the market is centred towards those whose income falls in the category of around Rs 70 to 80k per month, implying that certain forms of coverage (especially health insurance) is quiet abysmal. Above all, insurance companies are not an active part of the financial markets, from where these funds could be channelled to private businesses. Their main investment, like banks, is in PIBs and treasuries.

The presences of middle men and products like ‘bancasurance’ (coming together of banks and insurance companies) have spread considerable misinformation about the nature and working of insurance schemes.[19] Majority of the buyers have little or no understanding of what they are buying since deceptive marketing tactics are prevalent. Most of the insurance plans are sold as some kind of an investment scheme that will garner a handsome return for the buyer. But majority of the buyers, for example, aren’t made aware that they will have to bind their investment for a certain time.

____________________________

[13]‘Banks and capital markets: a two-way nexus’ (2010), Biagio Bossone.

[14]https://www.ecb.europa.eu/pub/pdf/fsr/art/ecb.fsrart200912en_05.pdf

[15]‘The role of insurance in in ensuring financial market liquidity’ (2010), Phillip Trainer.

[16]It is pertinent to mention here that of the 83 percent, 55 percent is in the short term T-bills while 28 percent in long-term PIBs. This ratio was almost equal at 43 percent in December 2016 (86 percent of banks’ investment even back then were in these instruments). But from thereon, there was a pronounced departure towards short-term T-bills. See chart 4, p.4, ‘Mid-Year performance review of the banking sector (Jan-June 2019), SBP.

[17]Source: SBP.

[18]‘Insurance Year Book, 2018-19’, Insurance Association of Pakistan.

[19]‘The great life insurance swindle’, Profit Pakistan.

Regulator Related Issues

There is genuine lack of understanding and capacity when it comes to expanding the role of financial markets, especially at the bureaucratic level. Historically, its work has been impeded due to several reasons, one of them being the constant changes at the top. In past 21 years, only 3 out of 13 commissioners have completed their terms! Overall, there is considerable uncertainty regarding the continuation of rules and regulations. The Companies Act 2017 was recently amended in April 2020 by the government, but the amendments were taken back in July.[20] Similarly, the procedures governing Asset Management Companies were recently revised again through an SRO.[21] Whether good or bad, continued revisions are an apt reflection of the arbitrary nature of decision making in terms of this important sector.

Sectoral approach is being followed on functional basis with teams divided into their own portfolios resulting in regulatory burden. There is also an impression of there not being clear rules, regulations and mandate to fulfil its obligations, or to help in expansion of financial markets. For e-g, insurance laws do not allow for investment in long-term securities (like mortgages). Similarly, there have been repeated episodes of broker custody defaults, which recently led Security and Exchange Commission of Pakistan (SECP) to again amend its rules.[22]

SECP consolidated all exchanges into PSX and then sold 40 percent to anchor investors including three Chinese Exchanges. Now we have a demutualised exchange sold to Chinese investors. However, the owners of the single stock exchange do not seem to be ready to develop the market.

The State of Financial Markets in Pakistan

This review suggests that the state of financial markets in Pakistan should be of serious concern to the policymaker. Most commentators argue that the major issue facing the financial market and its performance is that there is no domestic constituency/demand for reforms. An example is the SECP, which only came into being after Asian Development Bank (ADB) pushed for its founding. ADB is in the process of approving another $900 million loan, part of which would be allocated to development of capital markets.[23] It again raises the important question of why do we need donors to pinpoint these issues? Is there a domestic constituency for reforms?

____________________________

[20]‘Govt. withdraws six amendments to Companies Act 2017’, The NEWS, 9th July 2020.

[21]‘SECP revises procedures for Asset Management Companies’, Sohail Sarfaraz, BR, 11th July 2020.

[22]‘SECP amends rules to ensure investment protection’, Profit Pakistan, 3rd February 2020.

[23]‘ADB to provide Rs 274 bn to Pakistan’, The NEWS, 25th April 2020.

Out of the 33 banks, only 3 are investment banks but they hardly issue anything. This serves as an indication of the lack of depth and maturity of the financial markets in Pakistan because leading investment banks like Goldman Sachs, JP Morgan, etc., have an important role to perform in the economy. Not only do they manage personal and institutional wealth funds, handle mergers and acquisitions and act as financial advisors to governments on financial markets (raising debt, for example), but they also underwrite new stock issues! Also, they help corporations raise debt through corporate bonds by attracting investors in these instruments. Therefore, the mere presence of 3 investment banks points to:

- A lack of demand by corporations/businesses to raise debt through Corporate Bonds, Term Finance Certificate (TFC), Sukkuk Certificates, Registered Bonds, Corporate Bonds, etc.

- A lack of interest in terms of other stated functions (underwriting new stock issues, for e-g).

In terms of ‘a’, the percentage of issued corporate bonds stands at 0.17 percent of the total bonds issued in PKR, while its 37 percent in terms of total issue of dollar denominated bonds.[24] In terms of ‘b’, the falling number of firms at PSX has already been mentioned as a source of worry.

There are no new issues to talk about, volumes are shrinking, primary and secondary markets are non-functioning or functioning below par. Three leading players of the Pakistani financial markets are Pakistan Stock Exchange (PSX), Central Depository Company (CDC) and National Clearing Company of Pakistan Limited (NCCPL), whose role is seen as monopolistic which implies that the optimum level of market competition is absent.[25]

Conclusion

There have recently been steps aimed at improving the financial markets and their performance. Government, for example, raised Rs 200 billion Sukkuk debt through competitive book building. Institutional investments in NSS have been banned (to incentivise recourse to financial market), the process of IPOs has been digitalised, etc., but there still remains a lot more to be done to expand the scope of financial markets in Pakistan.

Recently, The Karachi Electric Supply Corporation (KESC) issued debt in China rather than resorting to PSX.[26] What explains this perplexing behaviour is the way that the financial markets function in Pakistan, and its structure. Firms like KESC rarely need to issue long-term debt in Pakistan’s financial markets because short-term debt takes care of their operational costs.

The safest short-term securities are the riskless government securities (t-bills), which cater to firms’ requirements for short-term investing with guaranteed returns. Therefore, there is little need to search for, or introduce, long-term innovative debt instruments since the issue of short-term public deb takes care of financing requirement of majority of institutions that demand credit. Similarly, the presence of schemes like National Savings, which offer lucrative returns for little or no risk, serves as an added disincentive for institutions like commercial and investment banks to introduce innovative debt products in the financial markets. These institutions are more than happy to serve the government and large-scale commercial customers rather than rolling out innovative products for raising debt.

____________________

[24]cbonds.com/countries/Pakistan-bond.

[25]PSX is concerned with trading in stocks, NCCPL performs the clearing and settlement function, and CDC is the custodian of investments.

[26]Statement by KESC representative, 3rd PIDE webinar on Financial markets in Pakistan.

To sum it up, the development of Pakistan’s financial markets are mainly restrained by poor governance at the institutional level and the actions of financial market participants, especially the large players who are risk-averse. Some suggestions to improve the overall situation are stated in the following lines.

- The government, especially the federal government, will have to take lead in terms of correcting the direction that could set the financial markets on a sustainable growth/expansion trajectory. Aside from dealing with the governance issues at the institutional level (like at SECP), it needs to consider the avenues of financing its expenditures and how these deter expansion of financial markets.

- Efforts need to be made to lessen serious dearth of new, innovative financing products allowing instruments like BADLA financing would increase the depth, liquidity, transactions and reach of the financial markets.

- Analyse taxation structure and regulations related to financial markets, especially Capital Gains Tax (CGT). For e-g, there is a strong perception that the cumbersome and time-consuming account opening and registration process for foreigners as they get discouraged and overwhelmed with the current registration structure and look for better investment alternatives in region/markets.

- An over regulated market puts firms at a greater probability of financial default and results in a narrow representation of the economy. For e-g, mandatory information disclosures should be reduced since issuers are uncomfortable in terms of publishing information about some of their proprietary products. Plus, ease of regulations would incentivise family owned firms to list and raise money through financial markets rather than banks.

- PSX is going to be profitable is when its dividend from its subsidiaries and affiliated companies are included so as to run it as a profitable business. It must strategies and should think of its stakeholders. The board related issues must be evaluated as more focus on the composition of the board by introducing the effective rules of staggered board.

- Although PSX has made strides in applying technological in the form of Automated Trading System (ATS), digital experience should be enhanced further as per the modern trends such as payment gateway, online biometric verification, etc. must be employed and consistently upgraded.

- HR quality must be improved by engaging relevant professionals as no proper accreditation mechanism exists at the PSX and SECP levels.

- The monopoly of PSX is perceived as a major issue in development of stock market. We must have more markets. We might move towards establishing different exchanges like SME Exchange, technological exchange, etc. with fewer regulations to provide them an opportunity to raise their required capital.

- The whole ecosystem (brokers, investors, etc.) need to perpetuate culture of investing in capital markets, and so does the SECP. They need to allocate funds for marketing rather than SECP, whose role should mainly be as a supportive institution.