Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Exchange Rate – Overshoot, Readjust and Overvalued

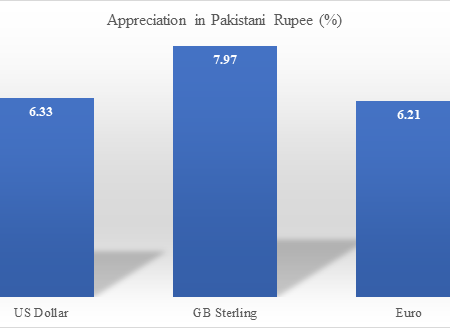

Appreciation of the Pakistani Rupee against all major currencies in August this year took many by surprise. The rate moved from PKR 168/USD to around PKR 158/USD. During this period, Dollar index has gone down by 0.7 percent while rupee gained strength by 6.3 percent against dollar; 6.2 percent against Sterling and 8 percent against Euro. This implies that rupee gained strength against all major currencies.

Overvalued Exchange Rate and Depreciation

Pakistan’s exchange rate has always remained overvalued. IMF, in 2017, called Pakistan’s currency overvalued by as much as 20 per cent. At the time the currency value was controlled at PKR 105/USD. In November 2017 the government started currency depreciation against US Dollar and the rate reached PKR 147/USD by May 2019. In two years the currency has depreciated by 28.5 percent, covered the overvalued part of the currency. Albeit, the difference in the rate of inflation was more than 8.5 percent that implies that our currency was still overvalued.

Depreciation and Readjustments

In June 2019, the exchange rate adjusted again to PKR 163/USD, i.e. a 9.8 percent depreciation followed by adjustment in the next few months by 5.2 percent to PKR 155/USD. Consequently, 5.2 percent depreciation of rupee occured against the US Dollar by December 2019.

In March 2020, at the start of COVID-19 in Pakistan, exchange rate again overshot by 6.7 percent to PKR 166/USD partly due to outflow of USD 1.89 billion of hot money followed by 2.4 percent adjustment to PKR 162/USD in the next two months. However, it reached PKR 167/USD and remained around this value by August 2020. The maximum value of the exchange rate was PKR 168/USD on 26 August 2020. Hence the overall depreciation since February 2020 till 26 August 2020 was 8.3 percent. Nevertheless, a 32 percent depreciation of the exchange rate occurred between 2017 and February this year.

Recent Appreciation

Multiple reasons can account for the surprise 6.3 percent appreciation in the Pakistani Rupee against US Dollar during the last three months. Few reasons discussed in different forums and webinars are; (i) postponing of loans (ii) getting relief aid (iii) exports having achieved higher growth than imports (iv) increase in remittances (v) current account surplus (vi) saving in forex spending on foreign tours, foreign education, Umrah and Hajj, (vii) dollars inflow in open market and (viii) possibility of increase in for-ex reserves.

Nonetheless, many have argued that the appreciation is not sustainable. Also the market predicts heavy depreciation in the third quarter of FY21. Few reasons among these are: (i) historical reputation of external market and (ii) behavior of exchange rate.

During July-September 2020-21 remittances increased by 31 percent from USD 5.452 billion in 2019-20 to USD 7.147 billion in 2020-21, i.e., adding USD 1.694 billion dollars to for-ex reserves. But this may not be sustainable. Though we may not face issue of sudden stop but the growth of remittances may not remain the same because; (i) remitters sent remittances to their families in the severe need of pandemic (ii) decline in informal channels of remitting due to travel restrictions and (iii) return migrant, due to job loss, might sold their belongings and sent back their money.

The Interest Rate and Inflation

Interest rate has not changed in the last three months. Whereas, inflation first decreased due to lower demand effect and then increased due to supply effect (cost push). Inflation difference to world inflation has also increased in the last three months that could have pushed exchange rate to depreciate. On the contrary our rupee gained value against the foreign currencies. Therefore, interest rate and inflation are not the reasons of appreciation.

Exports as well as imports have negative growth rate compared to last year same period. Trade deficit is increasing. Therefore, external balance is not explaining the current appreciation.

Combining all the factors that increase foreign exchange reserves, we can fairly conclude that remittances as well as deferment of loan payments and relief aid may have contributed positively in increasing for-ex reserves. However, in August 2020 the total for-ex reserves stood at USD 19.91 billion (USD 12.74 billion held by SBP and USD 7.17 held by private banks). For-ex reserves totaled USD 19.91 billion (USD 12.74 billion held by SBP and USD 7.17 held by the banks) on November 6 this year.

Conclusion

The accumulated effect of inflation is 26 percent since 2017, while US accumulated inflation is around 7.5 percent. Looking at the inflation differential, 37.5 percent depreciation till August 26, 2020 from 2017 seems reasonable if we accept that our Rupee was 20 percent overvalued in 2017. Thus, the recent appreciation of the exchange rate means the Pakistani Rupee is again overvalued.

On the other hand, Dornbusch’s overshooting of exchange rate can explain the spike in exchange rate due to COVID-19 panic in March 2020. Though it was adjusted in the next two months, nevertheless, recent appreciation is partly associated with the downward adjustment of excessive overshooting. As well as appreciation is also associated with the excess supply of foreign exchange in the open market.

Download full PDF