Pakistan Institute of Development Economics

- Home

Our Portals

MenuMenuMenuMenuMenuMenuMenu - ResearchMenuMenuMenuMenuMenuMenuMenu

- Discourse

- The PDR

- Our Researchers

- Academics

- Degree Verification

- Thesis Portal

- Our Portals

Domestic Commerce: Key Issues and Possible Interventions

Domestic Commerce: Key Issues and Possible Interventions

Raja Rafiullah, Pakistan Institute of Development Economics, Islamabad.

INTRODUCTION

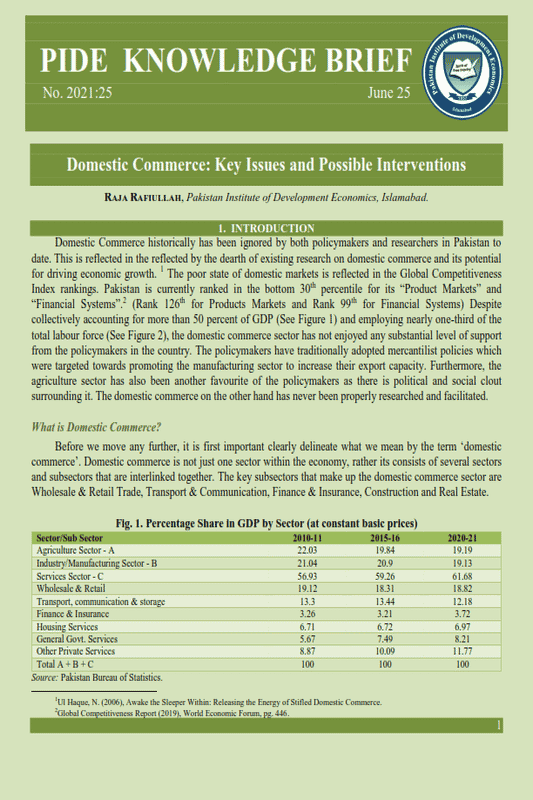

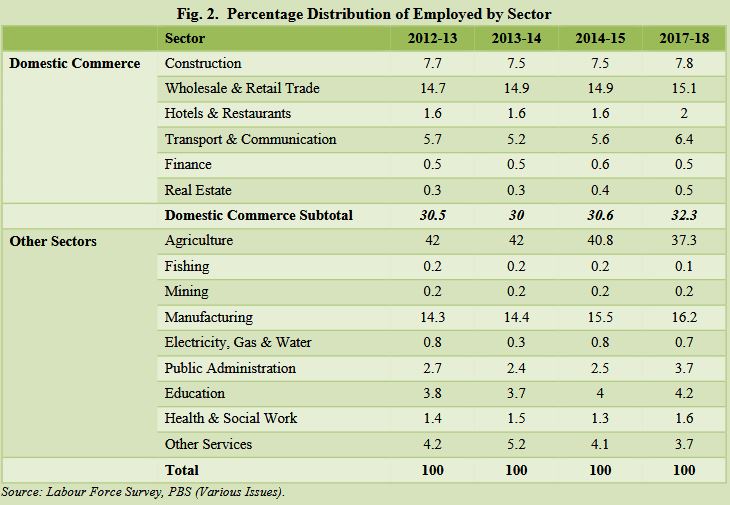

Domestic Commerce historically has been ignored by both policy-makers and researchers in Pakistan to date. This is reflected in the reflected by the dearth of existing research on domestic commerce and its potential for driving economic growth. [1] The poor state of domestic markets is reflected in the Global Competitiveness Index rankings. Pakistan is currently ranked in the bottom 30th percentile for its “Product Markets” and “Financial Systems”.[2] (Rank 126th for Products Markets and Rank 99th for Financial Systems) Despite collectively accounting for more than 50 percent of GDP (see Figure 1) and employing nearly one-third of the total labour force (see Figure 2), the domestic commerce sector has not enjoyed any substantial level of support from the policy-makers in the country. The policy-makers have traditionally adopted mercantilist policies which were targeted towards promoting the manufacturing sector to increase their export capacity. Furthermore, the agriculture sector has also been another favourite of the policy-makers as there is political and social clout surrounding it. The domestic commerce on the other hand has never been properly researched and facilitated.

What is Domestic Commerce?

Before we move any further, it is first important clearly delineate what we mean by the term ‘domestic commerce’. Domestic commerce is not just one sector within the economy, rather its consists of several sectors and subsectors that are interlinked together. The key subsectors that make up the domestic commerce sector are Wholesale & Retail Trade, Transport & Communication, Finance & Insurance, Construction and Real Estate.

_______________________

_______________________

[1]Ul Haque, N. (2006), Awake the Sleeper Within: Releasing the Energy of Stifled Domestic Commerce.

[2]Global Competitiveness Report (2019), World Economic Forum, pg. 446.

FACTORS AFFECTING DOMESTIC COMMERCE

Following is a list of main impediments to the growth of vibrant and competitive domestic commerce markets in Pakistan:

2.1. City Management and Zoning

The current zoning regulations in cities have an anti-commerce bias. The zoning regulations are as such that they favour single-use low-rise family houses while restricting domestic commerce activities to rigidly defined ‘commercial zones’.[3] Those zones that are defined as housing cannot be legally used for commercial purposes. These policies have led to a scarcity of commercial space in cities with businesses being charged exorbitant rates for office and commercial space. This in turn has resulted in many businesses illegally using residential zones for commercial activities. The outdated zoning regulations combined with building height restrictions mean that there is no room for both high-rise and mixed-use of plot space. There is also no system that allows for commercial warehousing and storage needs which has resulted in businesses using residential spaces for storing and warehousing.

_________________________

[3]Ul Haque, N. et al. (2020), Lahore’s Urban Dilemma, Pakistan Institute of Development Economics (PIDE).

2.2. The Complex Tax System

The domestic commerce sector is visited at average more times by the tax authorities than other sectors such as manufacturing which has traditionally been favoured by policy-makers in Pakistan. In Pakistan despite the country having a lower total effective tax rate (34 percent) than the average of South Asian economies (44 percent), the cost of tax compliance is still high particularly due to high number of hours (577 hours per year) that is take a business to file all taxes. This combined with the number of total payments (47) that a business has to make per year, are two driving factors behind non-compliance in the country. [4] The cumbersome tax filing system is partly to blame for the domestic businesses’ incentive to remain small and not grow. Policy steps that can be taken to make the tax system simpler are outlined later in this document.

The domestic commerce sector is visited at average more times by the tax authorities than other sectors such as manufacturing which has traditionally been favoured by policy-makers in Pakistan. In Pakistan despite the country having a lower total effective tax rate (34 percent) than the average of South Asian economies (44 percent), the cost of tax compliance is still high particularly due to high number of hours (577 hours per year) that is take a business to file all taxes. This combined with the number of total payments (47) that a business has to make per year, are two driving factors behind non-compliance in the country. [4] The cumbersome tax filing system is partly to blame for the domestic businesses’ incentive to remain small and not grow. Policy steps that can be taken to make the tax system simpler are outlined later in this document.

Over the past few years there has been a push for increasing tax related documentation to achieve a greater Tax-to-GDP ratio. The current target given by IMF is 16.7 percent which is to be met by FY 2021-22. [5] This target is unrealistic and has the contradictory effect of killing transactions in the economy and stifling growth. Furthermore, the current Tax-to-GDP ratio of 14 percent is not out of line with the regional averages: Sri Lanka (13 percent), India (18 percent) and Bangladesh (8.5 percent). [6]

___________________________

[4]Nasir, M., Faraz, N. & Anwar, S., (2020), Policy Viewpoint 17: Doing Taxes Better, Pakistan Institute of Development Economics (PIDE), pg. 4.

[5]Ibid. , Pg. 3.

[6]Ibid., Pg. 2.

2.3. Contract Enforcement and Legal Frameworks

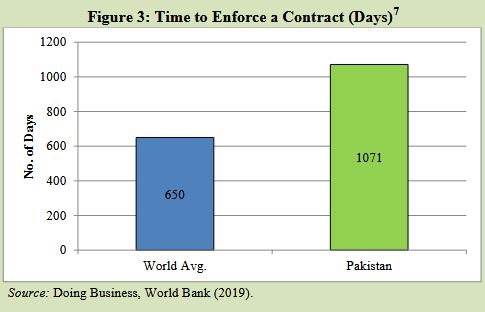

Another significant factor that affects growth of competitive markets is the poor integration of the legal system with the economy. Property rights that include intellectual property rights are not adequately protected given the current legal framework. Furthermore, any disputes that go to courts take a lot of time to be resolved. This is reflected in average number of days that it takes for a dispute to be resolved and the relevant contract to be enforced. In Pakistan it takes an average of 1071 days to enforce a contract compared to the global average of 650 days. (See Figure 3).

3.1. Zoning and Building Regulations

- Professionalise City Management—City administration and land-use policies in Pakistan are in the hands of federally appointed bureaucrats who do not have expertise in professional city and urban planning. [8]Systems need to be developed that bring in up-to-date city planners who can formulate effective urban land use and zoning policies.

- Lower Commercialisation Fees—High commercial fees are a tax on commercial developed and impede growth of domestic commerce.

- Warehousing and Storage—Zoning of land needs to account for the fact that with commercial activity there comes the need for businesses to get access to storing and warehousing space. City planners on general and planners of numerous housing societies need to account for this requirement in their plans.

- Change/Relax Zoning Laws to Incorporate Mixed-Use of Land—The current zoning laws favour low-rise residential single unit housing. This leads to urban sprawling and leaves less room for commercial activities. Mixed-use of land i.e. allowing a plot of land to be used for both commercial and residential activities needs to be adopted. [9] This, however, would require a fundamental rethink of the current zoning laws that divide city space in inflexible dichotomous categories such as ‘residential’ and ‘commercial’. But if implemented corrected, this can alleviate some of the shortage of commercial and office space in cities.

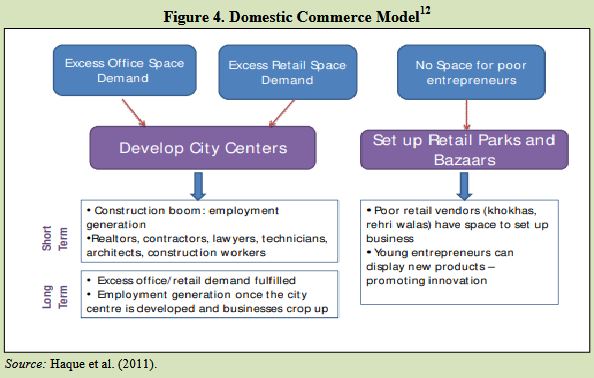

- Liberalise Building Regulations and Floor-Area-Ratios (FARs)—One important step towards both high-rise development and mix-use of space is to relax the arbitrarily set building height restrictions prevalent in most cities. For instance, in Lahore, the second largest metropolitan area in Pakistan, the current Floor Area Ratio (FAR) for approved apartment sites is 1:5 and for commercial plots is 1:6 as designated by Lahore Development Authority. [10]The FAR regulations need to be relaxed by a factor of 2 at the minimum. [11]This will allow for building of apartment sites that can replace single-use housing units and also allow for higher commercial building. These steps would in turn help towards addressing the shortage of space in Pakistani cities where commercial activities including domestic commerce can thrive. Extra space to address the high demand for commercial space would have a ripple effect with more business/commercial districts becoming centres of economic activity that facilitate economic growth. (See Figure 4).

- Abolish Arbitrary Height Restrictions—The height restrictions on building need to be abolished. Height restrictions don’t make sense when there are already Floor Area Ratios (FAR) regulations in place. This common perception among regulators that removing these restrictions will lead to an unabated growth of high-rise structures is unfounded in economic practicality. High-rise building is expensive and very often market forces rule out such unabated high-rise development because of high costs involved.

- Integrate Cities—The cities currently are also poorly integrated with different localities having their own rules for building regulations. Complex Development Authority rules in addition to rules of intra-city localities leads to a very complex regulatory situation that adversely affects commercial development. Commercialisation—“anything other than single-family housing—is arbitrary, cumbersome, ill-planned, and expensive”.[13] And in presence of complex regulations such commercialisation and real estate development have become rent-seeking games. [14] The need is to make regulations simpler and ensure that they apply to all localities within the city.

- Reduce Government Ownership of Downtown City Space—In Pakistani cities, most land still is owned by the government which often means that it is not used for commercial purposes. Government ownership of land needs to be reduced if it is an obstacle to growth of commerce in city downtowns. This land can be rented/leased out the private sector and be a source of income to the government.

_________________________________

[7]Doing Business Project Database (2019) , World Bank.

[8]Ul Haque, N. (2014), Achieving Progress, Growth, And Development Through Urban Renewal, Policy Brief Series: Pakistan’s Urbanisation, Wilson Center, Pg. 4.

[9]Ul Haque, N. et al. (2020), Lahore’s Urban Dilemma, PIDE Policy Viewpoint, Pakistan Institute of Development Economics , Pg. 2.

[10]LDA Land Use Rules, Lahore Development Authority.

[11]Ul Haque, N. et al. (2020), Lahore’s Urban Dilemma, PIDE Policy Viewpoint, Pakistan Institute of Development Economics , Pg. 3.

[12]Ul Haque, N., Ahmed, V. & Shahid, S. (2011), Reforms for Competitive Markets in Pakistan, Pg. 16.

3.2. Tax Reforms

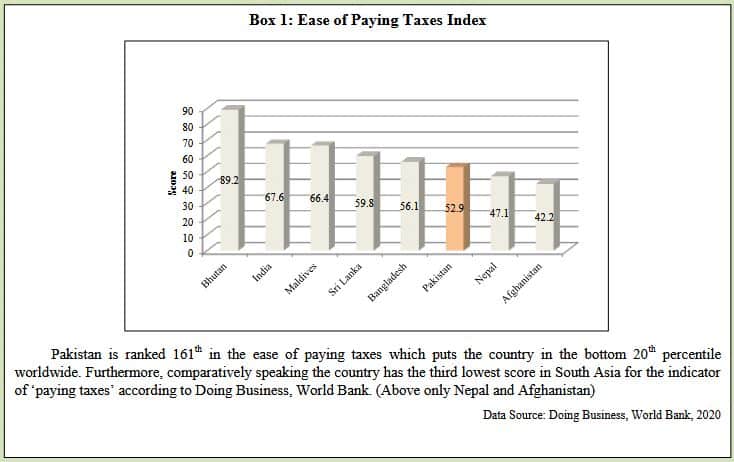

Despite Pakistan having a total tax rate (34 percent)[15] that is below the average of the South Asian region (44 percent) the country still has the third lowest ranking[16] in the region when it comes to ‘ease of paying taxes’ with only Nepal and Afghanistan ranked lower. This in part is due to the complexity of the system that requires a lot of hours and procedures to file taxes. This serves as a disincentive to businesses to file taxes and serves to kill total transactions in the economy.[17] The need of the hour is to simplify the system by reducing the number of both paper and online procedures.

- Broad, Simple and Low-rate Taxes—Tax reforms should be implemented that bring broad and low-rate simple taxes. [18] There should be a simple and predictable income tax regime. Those taxes that contribute less to revenue than the cost borne to collect them should be abolished.

- Harmonise the GST—The GST needs to be harmonised. Currently, the GST on goods comes under the mandate of centre, where as GST on services comes under the domain of the provinces. Recently, largely due to multilateral aid being made contingent on reform, steps have been made under the purview of a National Tax Council (NTC) to harmonise the GST. The prevailing COVID-19 pandemic meant that the meeting of NTC was delayed, but recently under the ambit of NTC the four provinces have signed a MOU to adopt a harmonised single GST. Hopefully this will result in a harmonised GST soon without the need for any constitutional amendments. The harmonised GST will enable those businesses who are operating nationwide, to file one single GST return instead of the five they currently have to file.

- Stop Issuing SROs—The tax regime also needs to become more predictable particularly during the course of a financial year. The practice of issuing statutory regulatory orders (SROs) by the Federal Board of Revenue (FBR) making changes to tax regime leads to unpredictably that hampers growth of private investment and creates fertile grounds for lobbyists to gain from meddling with the tax regime. The issuance of SROs was declared unconstitutional by the Supreme Court of Pakistan in 2013 on grounds that changes in tax regime without approval of legislature are unconstitutional, yet the FBR has continued the practice often coming up with elongated explanations to justify the constitutionality of the SROs.[19]

_________________________

[13]Ul Haque, N. (2014), Achieving Progress, Growth, And Development Through Urban Renewal, Policy Brief Series: Pakistan’s Urbanisation, Wilson Centre, Pg. 3.

[14]Ibid.

[15]DataBank (2019), Indicator: Total Tax and Contribution Rate (% of Profit), World Bank.

[16]DataBank (2019), Indicator: Paying Taxes, Doing Business, World Bank.

[17]Nasir, M., Faraz, N. & Anwar, S., (2020), Policy Viewpoint 17: Doing Taxes Better: Simply, Open and Grow Economy, Pakistan Institute of Development Economics (PIDE), Pg. 2.

[18]Bukhari, H. & Haq, I. (2016), Towards Flat, Low-rate, Broad and Predictable Taxes, Islamabad: Prime Institute.

[19]Nasir, M., Faraz, N. & Anwar, S., (2020), Policy Viewpoint 17: Doing Taxes Better: Simply, Open and Grow Economy , Pakistan Institute of Development Economics (PIDE), Pg. 7.

3.3. Legal Reforms

The judicial process in Pakistan is notoriously slow and inefficient with millions of cases pending in courts at any given time in the country. This is also true when it comes to enforcement of legal contracts with regards to businesses. As pointed out earlier in this piece, it takes considerably more days in Pakistan (1071 days) at average to enforce a contract as compared to the global average (650 days). The poor and slow integration of the judicial system with the economy hampers growth of business and new private investment as long legal battles are costly to businesses and lead to uncertainty.

- Commercial Courts—The country needs to consider setting up of commercial courts on a serious basis. The current PTI government like some of its past predecessors claimed that it was going to facilitate setting up of such commercial courts in 2019. But as to how much progress has been made on this front is not entirely clear. These courts can either be set up as separate entities or be part of existing chambers, or provide judiciary trained specifically in handling business-related matters. Such courts have the potential of reducing the number of days it takes for a case to be resolved. This then can lead to a more secure and certain environment for businesses and private investors with regards to enforcement of contracts. The Ministry of Law, Justice and Parliamentary Affairs and the Ministry of Commerce need to collaborate effectively to produce tangible results in this domain.

- Alternate Dispute Resolutions (ADR) Systems—Gains have been made in this space over the past few years. Islamabad Capital’s ADR Act 2017, Punjab ADR Act 2019 and Sindh’s Code of Civil Procedure Bill 2018 have made alternative dispute resolution written into constitutional law in these jurisdictions.[20] This trend needs to extend throughout the country along with active capacity building of judiciary to participate and implement the ADR systems more effectively. Swift resolution of commercial and business disputes must be given priority so that investors and businessmen can operate in a more legally secure environment.

- Time Limits—Limits on the amount of time it takes for a decision to be reached particularly in commercial and business matters need to be looked at more seriously. Such limits can help reduce the environment of uncertainty that businesses and investors face.

______________________

[20]Hussain, S. (2019), Alternate Dispute Resolution Gains Traction in Pakistan, The Asia Foundation.

REFERENCES

Ahmed, V. (2011). Reforms for Competitive Markets in Pakistan.

Bukhari, H. and Haq, I. (2020). Towards Flat, Low-rate, Broad and Predictable Taxes. Prime Institute.

Hussain, S. (2019). Alternate Dispute Resolution Gains Traction in Pakistan. The Asia Foundation.

Lahore Development Authority (2020). Land Use Rules, 2020. Lahore Development Authority.

Nasir, M., Faraz, N. & Anwar, S. (2020). Doing Taxes Better. Pakistan Institute of Development Economics.

Pakistan Bureau of Statistics (2018). Pakistan Employment Trends, 2018.

Ul Haque, N. et al. (2021). Lahore’s Urban Dilemma. Pakistan Institute of Development Economics.

Ul Haque, N. (2006). Awake the Sleeper Within: Releasing the Energy of Stifled Domestic Commerce. SSRN Electronic Journal.

Ul Haque, N. (2006). Awake the Sleeper Within: Releasing the Energy of Stifled.

Ul Haque, N. (2014). Achieving Progress, Growth, And Development Through Urban Renewal. Policy Brief Series: Pakistan’s Urbanisation. Wilson Centre.

World Bank (2019). Doing Business Report.

World Development Indicators (2019). World Bank.

World Economic Forum (2019). Global Competitiveness Report.